Interviewer: Could you share some information about BIDV’s green banking activities?

In recent years, Vietnam has continuously paid attention to building and developing a green economy. The Prime Minister issued Decision No. 1658/QĐ-TTg dated October 1, 2021, approving the National Green Growth Strategy for the period 2021–2030, with a vision to 2050; and Decision No. 882/QĐ-TTg dated July 22, 2022, approving the National Action Plan for Green Growth for the period 2021–2030. For the Vietnamese banking sector, since August 7, 2018, the Governor of the State Bank of Vietnam (SBV) has issued Decision No. 1604/QĐ-NHNN approving the project on developing green banking in Vietnam, and Decision No. 1408/QĐ-NHNN dated July 26, 2023, regarding the banking sector’s action plan to implement the National Green Growth Strategy for 2021–2030 and the Project on tasks and solutions to implement the outcomes of the 26th Conference of the Parties (COP26) to the United Nations Framework Convention on Climate Change. Therefore, it can be seen that promoting green growth and sustainable economic development is a directive being strongly implemented by the Government and the State Bank of Vietnam.

BIDV is proud to be the oldest bank in the system of credit institutions in Vietnam. As of December 31, 2024, BIDV was the bank with the largest total assets in Vietnam, with nearly VND 2.7 quadrillion, equivalent to more than USD 100 billion. BIDV is also the bank with the largest total outstanding loans to the economy, with over VND 2.01 quadrillion. Among that, BIDV continues to maintain its position as the bank with the largest green credit outstanding loans in Vietnam, with a total of over VND 75 trillion, accounting for nearly 12% of the total green credit outstanding loans of the entire economy and nearly 4% of BIDV’s total lending.

BIDV’s Board of Directors has early recognized the necessity and importance of orienting the development of BIDV into a green and sustainable bank. Accordingly, BIDV has early implemented a strategic and comprehensive plan with very encouraging initial results.

Regarding the strategic orientation for green banking development, BIDV identifies four pillars, which are also the driving forces that create the distinctive positioning of the green banking brand, including: (i) Striving to maintain scale and leading position in green finance; (ii) Implementing green banking activities at BIDV comprehensively and holistically; (iii) Focusing on comprehensive digitalization in both management and business development; (iv) Building and spreading a green/sustainable development culture throughout the entire system and broadly to the social community.

Recently, BIDV has been the first bank to sign a cooperation agreement with the Ministry of Natural Resources and Environment (now the Ministry of Agriculture and Environment) regarding the promotion of sustainable green finance development, environmental protection, and climate change response. BIDV is also the first bank to successfully issue VND 2.5 trillion of green bonds in accordance with international principles, pioneering the issuance of a Sustainable Loan Framework and the implementation of the Environmental and Social Risk Management Framework in trade finance activities. Currently, BIDV is also working with a leading global consultancy to continue refining the orientation for green banking brand positioning to 2030 and beyond.

With its traditional profession, in recent years, BIDV has continuously implemented many credit packages to accompany individual and corporate customers in the green transition journey, such as a VND 10 trillion credit package for individual customers in green business production, a VND 4.2 trillion credit package to support textile enterprises in green transition, a VND 10 trillion package to support businesses in green building renovation,…

Faced with the development of science and technology, especially in the fields of digital transformation, artificial intelligence, big data…, BIDV constantly invests in IT applications, develops banking products and services, and applications for individual and business customers. The application of technology in data and transaction management also optimizes resources and minimizes energy waste. The development of digital banking not only brings economic benefits but also plays an important role in building a more sustainable future. It can be confidently affirmed that BIDV’s new-generation SmartBanking application for individual customers offers a friendly, advanced, convenient, and secure financial service experience that is highly appreciated by customers. BIDV SmartBanking delivers a unified and completely new user interface experience, allowing users to personalize and customize the interface in real-time according to their preferences… Meanwhile, BIDV iBank provides a seamless, cross-platform online banking ecosystem for corporate customers and was honored as the Most Innovative Digital Application in Vietnam in 2021 by Global Banking & Finance magazine; and received the Sao Khue Award in 2022 from the Vietnam Software and IT Services Association – VINASA,…

Together with its business activities, for many years now, BIDV has always paid attention to promoting social security activities associated with the image of a green bank. Each year, BIDV allocates VND 300–400 billion to implement social security activities, in which many Green programs have become familiar brands to the media and the social community such as: “Planting one million trees by 2025”, “Fresh water for a green life”, the charity run “For a green life”, “Warm Tet for the poor”, building “flood-resistant community houses”, “lifebuoy schoolbags” for children in flood-prone areas…

Interviewer: In 2024, at the Announcement Ceremony of Sustainable Businesses in Vietnam organized by VCCI and the Vietnam Business Council for Sustainable Development (VBCSD-VCCI), BIDV was honored for the 6th time among the Top Sustainable Businesses in the trade and services sector. This is recognition of BIDV’s efforts. In which, the communication work for positioning the green banking brand also made positive contributions. Could you share more about this?

On April 26, 2022, on the occasion of the 65th anniversary of its founding, BIDV officially changed its brand identity to emerald green, combined with the yellow color of the national flag’s golden star as the primary brand color. With its widespread distribution network across the country, the image of a green bank has been positioned to the public.

At the same time, to implement the communication of the “green bank” brand, BIDV focuses on three target groups:

The first is BIDV’s staff. These are the “ambassadors” spreading green messages from within the bank. BIDV has early organized training courses and workshops for all levels of employees throughout the system, especially professional units, on the green banking model, environmental and social risk assessment management frameworks, general knowledge about ESG and sustainable development,… BIDV also digitizes processes to reduce the use of paper and ink, encourages movements to build green offices, and reduce plastic waste, contributing to forming a green culture among each employee.

The second is the group of corporate customers with over 500,000 organizations, corporations, general companies, SMEs, FDI enterprises,… BIDV regularly communicates and introduces via diverse methods such as direct meetings, exchanges via digital communication channels, banking service applications, and regularly organizes various business connection activities. BIDV accompanies enterprises to orient and optimize resources during the green transition process. BIDV coordinates with ministries, localities, and domestic and international organizations to organize many seminars, provide consulting, and connect businesses with experts and managers inside and outside Vietnam to timely share opportunities and challenges in the green transition when participating in global supply chains.

The third is the individual customer group with a base of over 22 million customers. On one hand, BIDV communicates and introduces financial solutions through digital technology applications such as SmartBanking, and information groups on social platforms… On the other hand, with a network of over 1,200 transaction points nationwide, BIDV conducts communication activities through direct customer care and timely provides useful information to customers. Besides, BIDV regularly organizes many community activities to create opportunities for individual customers to participate, such as the charity run “For a Green Life”, “Warm Tet for the Poor”…

Interviewer: It is known that in recent years, BIDV has also paid special attention to personal financial education programs for the community. Is this also a communication solution for positioning the “Green Bank” brand?

Exactly. We believe that if the general awareness of the community about finance in general and green finance in particular is enhanced, then the effectiveness of implementing strategic plans to build a Green Bank will also be improved.

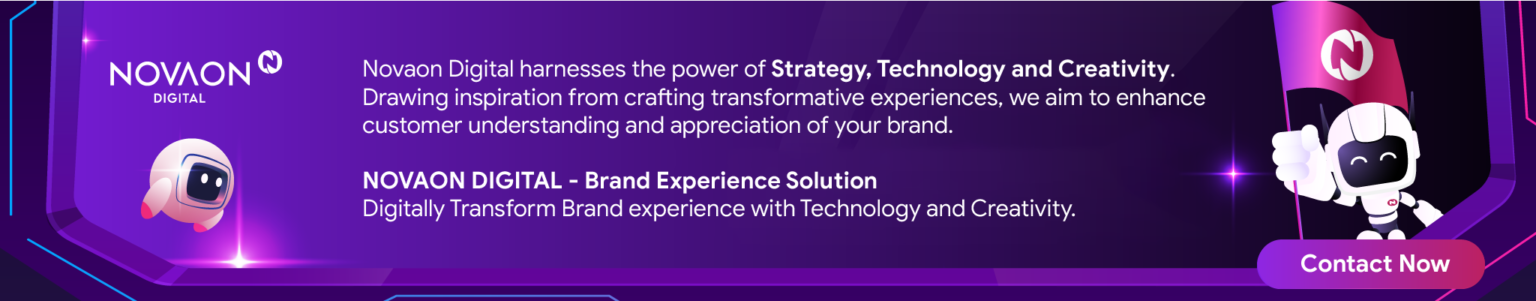

In 2024, BIDV cooperated with VTV Times to launch for the first time the program “The Moneyverse” – a financial education program aimed at Vietnamese university students.

With the goal of increasing financial and banking knowledge dissemination to the public, especially young people, BIDV became the strategic companion of the program. We aim to turn what seems like dry financial knowledge into an entertaining and engaging experience through a combination of game show and reality TV format. BIDV’s financial experts collaborated with the production team to incorporate information on ESG, green banking activities, and digital banking of BIDV into the quiz rounds.

The program attracted the attention and participation of over 150,000 students from 27 universities nationwide. In addition to providing skills in personal financial management, the program also helped young people better understand ESG concepts, the Vietnamese Government’s commitment to achieving Net Zero by 2050, and thereby deepen their awareness of their role in the journey toward sustainable development together with the community.

With BIDV’s support, Season 1 of The Moneyverse achieved positive results with ratings reaching the top 1 in its broadcast time slot (Source: Kantar Media, VTV.vn). According to data from SocialTrend, during the week of October 29 to November 4, 2024, “The Moneyverse” ranked among the top 10 most-discussed programs on social media.

This is not only a sustainable development strategy but also a humanitarian step, opening up greater opportunities for the community in the future.

BIDV pioneers the implementation of personal financial education.

Cre: Novaon Digital

Interviewer: Has this process encountered any challenges, sir?

In terms of brand communication, we did face several challenges during the initial stage of pursuing the green banking positioning.

As mentioned earlier, this is a major directive from the Government. However, communication efforts have not yet been strong enough to effectively influence the public. Concepts such as ESG, Net Zero, or sustainable development are still relatively new. Similarly, in the banking sector, communication on green growth and green banking needs to be further strengthened to gradually shift public perception — turning awareness into action, and action into prioritization of green transition for the common goal.

In addition, building a green economy and sustainable development requires the active and coordinated participation of government agencies, local authorities, businesses, organizations, banks, and the wider community. Among them, banks — as the lifeblood of the economy — will provide green financial services and mobilize resources to support enterprises in their green transition journey.

Notably, in the context of Vietnam’s deepening integration into the global economy, recent shifts in the United States’ policies regarding previous commitments to sustainable development may pose significant challenges to the global effort in complying with green development regulations.

Nevertheless, we still consider this an opportunity to take the lead in building the “green bank” brand image and to remain steadfast in our pursuit of the common goal: working hand-in-hand with the community and businesses towards sustainable economic development.

Interviewer: Could you share BIDV’s experience in overcoming these difficulties to organize effective communication activities?

BIDV hopes to continue receiving the support and cooperation of organizations, the business community, society, and each individual customer so that together we can take action toward the shared goal of a green future.

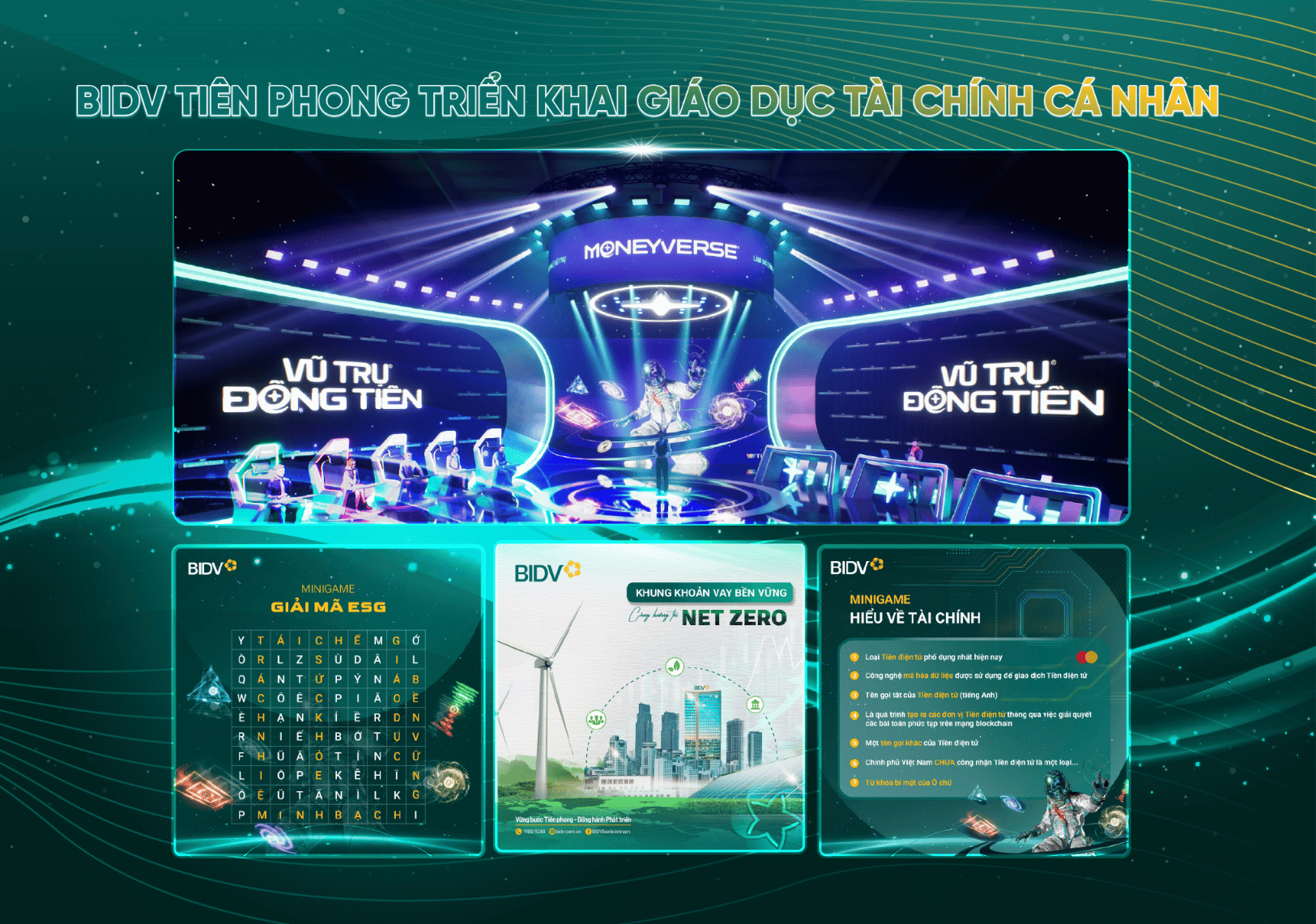

We have developed a communication model based on the 5G framework to position ourselves as a green bank, including: Green Product, Green Internal, Green CSR, Green Living, and Green Campaign. Through this model, BIDV encourages employees and customers to change their habits — from managing finances to choosing daily products. Green lifestyle campaigns such as reducing plastic waste, tree planting, online charity runs, or using eco-friendly products are strongly promoted through educational and creative communication activities. With this direction, BIDV is not only positioning itself as a green bank but also as a companion in promoting a sustainable lifestyle for the entire community.

BIDV inspires a green mindset within the community

Cre: Novaon Digital

In addition, we remain steadfast in our goal of delivering a clear and consistent “Green Bank” brand experience to our customers and the wider community. This is implemented through three main approaches:

First, we ensure consistent branding and green messaging across all touchpoints — from the design of transaction spaces at branches, the interface of digital banking applications, and the layout of communication materials to the way we organize and deploy community campaigns.

BIDV has also taken the lead in publishing its 2023 Sustainability Report under the theme “Shaping a Green Future,” aiming to enhance transparency in sustainable development activities and gain recognition from external organizations and stakeholders. This serves as concrete evidence of BIDV’s ongoing efforts in pursuing the green bank brand positioning strategy, spreading sustainable values, and promoting green growth and the green economy.

BIDV strengthens its communication with the public through its media presence on digital platforms such as the website, Facebook, TikTok, LinkedIn, YouTube, Zalo, etc. On the bank’s official website, BIDV has created a dedicated page to regularly update its green banking initiatives and green financial products and services.

The 5G Green Strategy Model implemented by BIDV

Cre: Novaon Digital

Interviewer: Looking back on BIDV’s journey in building the “Green Bank” brand, what do you consider the greatest value BIDV has brought to customers and the community?

The journey of building the “Green Bank” brand has enabled BIDV not only to affirm its pioneering position in the field of sustainable finance but also to spread positive values to the community and customers. The greatest value we have delivered is the connection between environmental responsibility and practical social benefits. In the future, BIDV will continue to uphold this role, laying a solid foundation for a green and sustainable financial ecosystem.

Our goal is not only to provide green financial solutions and services to our customers but also to contribute to raising public awareness about environmental protection, climate change, and the joint implementation of sustainable financial practices. Through this, we aim to inspire the community and spread the spirit of working together for a green future for generations to come.

BIDV affirms its position through numerous sustainability awards.

Cre: Novaon Digital

Thank you, Mr. Hà, for your valuable insights!

Sources: Brandsvietnam