Brandformance is the combination of the power of brand building and performance in communication strategies. This method is flexible and comprehensive, offering maximum benefits to businesses both in the short and long term.

In addition, the Banking – Finance sector in Vietnam is booming, particularly in the field of Marketing, with the strong spread of digital technology. How is the creative Brandformance strategy, combined with Big Data, artificial intelligence (AI), and personalized customer experiences, being driven by changing consumer needs in this industry?

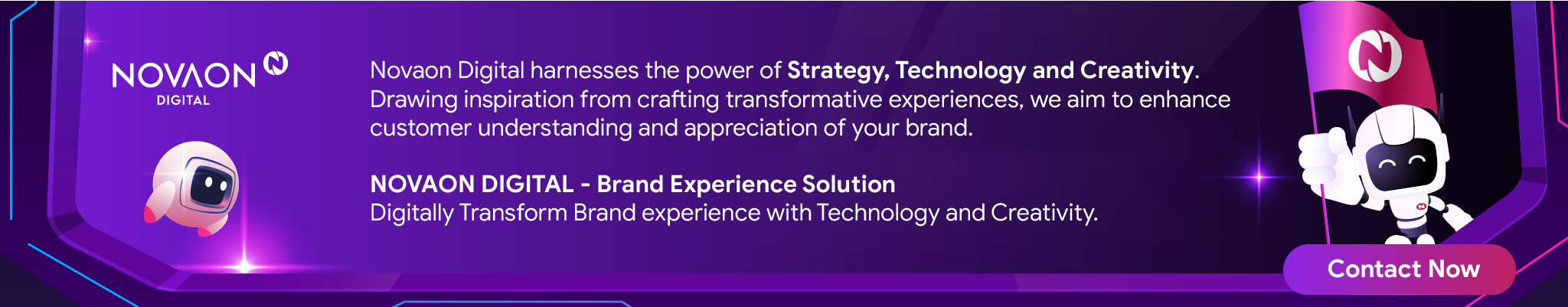

1. Banking – Finance businesses applying Innovative Marketing in Brandformance strategies

In the era of digital banking, innovative marketing activities revolve around using strategies on digital platforms, social media, and mobile apps. These tools play a crucial role, enabling targeted and precisely analyzed campaigns.

However, a report from Kantar indicates that brands risk declining sales if they focus too much on performance marketing while neglecting brand building. From 2019 to 2021, brands with increasing brand equity saw a 72% rise in brand value compared to only 20% for those with decreasing brand equity.

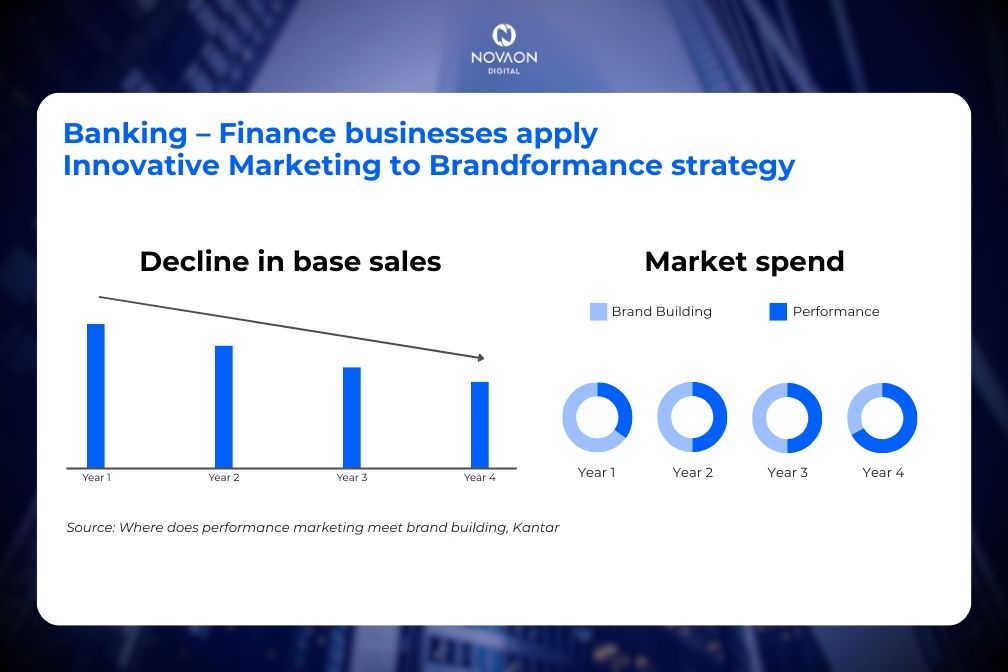

Allocating the majority or the entire budget to focus on PERFORMANCE mostly helps reach bottom-of-the-funnel customers—those with direct needs. This leads to several disadvantages for the brand:

- A significant decrease in the number of qualified leads.

- The conversion rate gradually declines over time.

- Selling to potential customers before they develop a need, making them uncomfortable.

On the other hand, allocating the majority or the entire budget to focus on BRANDING allows the brand to widen its funnel at the conversion stage, but it misses the opportunity to generate short-term revenue.

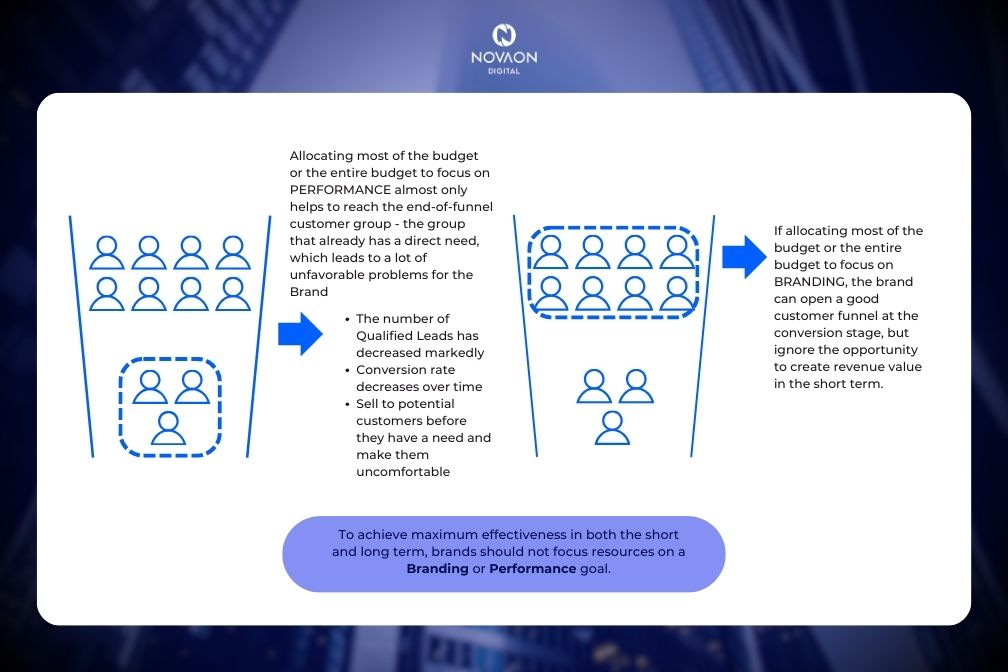

Therefore, Brandformance is the combination of these two elements in a single strategy, created to address the challenge of balancing short-term and long-term benefits. To successfully implement a Brandformance strategy, Novaon Digital emphasizes three key factors:

- Messages clearly derived from the target audience.

- Decisions based on data, data analysis, AI, and personalized customer experiences.

- The integration of creative marketing (Creative Marketing) and technological marketing (Technology Marketing), with both factors prioritized.

When starting to implement a marketing strategy, the banking and finance sector often faces many challenges. They need to clearly understand that convincing customers to make decisions takes time. It’s not just about “selling” through performance marketing; the banking and finance industry must invest time in branding to “convince” customers during their decision-making process. This is where the combination of creativity and technology in a specific Brandformance strategy, known as Innovative Marketing, becomes important.

As speaker Sylwia Kulesza noted: “Innovative Marketing: It’s not something grand, but the things that happen in life.” Therefore, it’s essential for customers to feel that every banking advertisement is personalized for them—this concept is known as Invisible Marketing.

Innovative Marketing is More Prevalent than Traditional Marketing

In the modern marketing world, the boundary between Creative Marketing and Innovative Marketing is not an insurmountable wall. In fact, they often overlap and interact strongly. This means that Innovative Marketing activities are not entirely new, but they still play a crucial role in driving growth and creating differentiation within a Brandformance strategy.

A prime example involves three key activities: market research, marketing campaigns, and marketing research & development (R&D). Currently, although these activities exist in parallel, they are not yet effectively connected and coordinated.

Market research provides essential insights into the market and consumers, but it is often not used creatively or innovatively in developing marketing strategies. Meanwhile, marketing campaigns typically focus on generating attention and engagement from customers but may lack critical feedback from the market through research. Finally, marketing R&D can generate new and creative ideas, but these efforts will not succeed unless they are applied in a real marketing campaign.

This integration of market research, innovative strategy, and creative execution is what makes Innovative Marketing more dynamic and adaptive than traditional approaches.

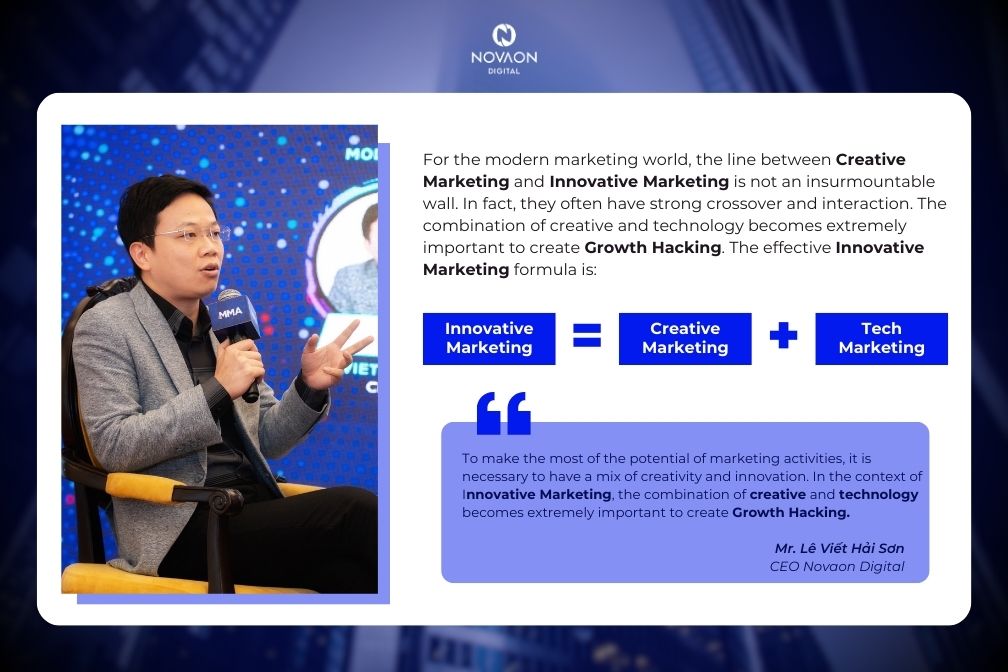

Mr. Le Viet Hai Son – CEO of Novaon Digital gave an assessment:

To fully leverage the potential of all three activities—market research, marketing campaigns, and marketing R&D—it is essential to blend creativity with innovation. In the context of Innovative Marketing, the combination of creativity (Creative) and technology (Technology) becomes crucial in driving Growth Hacking for a Brandformance strategy.

The formula for Innovative Marketing is:

Innovative Marketing = Creative Marketing + Tech Marketing

This approach not only allows businesses to use market insights in a creative and innovative way, but it also enables the creation of effective and breakthrough Brandformance strategies. By integrating creativity and technology, companies can unlock new opportunities, optimize performance, and create a competitive advantage in today’s dynamic market.

Applying the Brandformance strategy combined with Innovative Marketing is necessary for Banking – Finance businesses

Currently, businesses often focus primarily on creating content and solving specific problems. However, to ensure comprehensive technological development, it is essential to combine creativity, automation, and system building. For large financial institutions like banks, adopting a range of new technologies is crucial, including transitioning entirely to a more modern technological platform. For example, in the realm of technology, using advanced tools like Chat GPT can be considered a key strategy for optimizing interactions and communication with customers in a smart, automated way.

Financial institutions and banks need to leverage their vast customer data to enhance user engagement through personalized content. The synergy of content marketing and influencer marketing, combined with AR/VR on social media, will amplify brand recognition. Meanwhile, mobile applications offer tailored promotions, taking advantage of the widespread use of smartphones. Adapting to these digital avenues is the key to banks thriving in modern brand experiences while simultaneously increasing business revenue.

This holistic approach—blending creativity, technology, and personalized customer interaction—creates a more dynamic and competitive edge for financial institutions in today’s digital landscape.

2. Three levels of Innovative Marketing for Banking – Finance businesses towards B2B goals

One of the key tasks of technology is to help banks address current issues, including in the B2B sector. Although budgets are typically allocated for reaching individual customers, the question remains about how technology can be applied to help banks solve existing B2B challenges.

Techcombank has implemented a diverse roadmap, including banners, digital ads, and various other media to expand its reach. This is one of the technological solutions banks use to tackle their issues.

CEO Le Viet Hai Son emphasized that Innovative Marketing is not only necessary but also crucial. He outlined three levels of applying Innovative Marketing:

- Level 1: Combining traditional methods with technology.

- Level 2: Using Artificial Intelligence (AI) to support employees in executing marketing strategies.

- Level 3: Leveraging AI to contribute to the development of new products and services.

A specific example of Viettel’s approach to the rural market is a case study conducted to understand the benefits of implementing a mobile application in this market and how to deploy it more creatively and effectively.

The reality shows that the rural market is significant, comprising 65% of the population, and cannot be overlooked. However, technology remains a major barrier in these areas. Viettel developed a strategy aligned with the national digital transformation goals. Initially, the rollout of Viettel Pay (an e-wallet) faced challenges in rural areas. However, Viettel’s mission is to ensure that no one is left behind in the technology development process, so they focused on providing convenient transaction services for rural residents through the Mobile Money project. The implementation strategy targeted small traders (4.0 Markets) and students.

When starting to implement a Brandformance strategy with Innovative Marketing that combines Creative Marketing and Tech Marketing, businesses often encounter many challenges, making it difficult to ensure three critical elements: strategy, creativity, and technology in execution. Novaon Digital, a Brand Experience Agency, has been collaborating with major brands across various industries such as Peugeot, Vietnam Airlines, Mobifone, and Viettel to provide effective marketing communication solutions for businesses in the banking and finance sector.

3. The key role of AI and Big Data in enhancing customer experience and driving growth

Discussion on Digital Transformation in the Banking and Finance Sector & Revolutionizing Marketing Efficiency in Vietnam. Focusing on the crucial role of AI and Big Data in enhancing customer experiences and driving growth, Mr. Rohit Dadwal, CEO of MMA Global APAC and Global Director of SMARTIES™ Worldwide, stated: “The need for AI has long been established, from the era of in-store shopping to the emergence of the Digital Age, where interactions have become personalized and customer experiences have been enhanced through websites. We need to broaden our mindset to embrace and leverage AI due to its advantages in minimizing labor for repetitive tasks and the valuable data it provides.”

Assessing the period from 2016 to 2024, Mr. Rohit noted a 1000% increase in AI utilization performance and predicted that AI would support businesses in planning, operations, and marketing if leveraged correctly. The search for ROI when using AI, both online and offline, remains a top concern. Although AI is not widely adopted yet, it is expected to develop strongly and become as prevalent as mobile phones in the future. The expert urged businesses to start using AI now, believing that in the future, AI, robotics, and automation will become crucial partners in daily operations, helping to alleviate burdens and establish a new trend in the industry.

However, the choice of AI tools must be based on the specific needs of each sector, particularly in finance and budgeting, as profit margins play a vital role in marketing. This is a critical starting point to benefit from the power of AI and Big Data in today’s digital era.

Mr. Nguyen Duy Tuong, Digital Marketing Director and Magnet Program Manager at MSB, shared the bank’s ambition to transform the role of marketing within the Banking and Finance industry. With 16 years of experience in the field, he observed the evolution from the initial use of Internet Marketing and Advertising to the present, where the emergence of Digital Marketing has become an extremely effective marketing foundation for businesses.

Financial and banking enterprises need to build marketing campaigns based on customer behavior, use more customer tracking tools both online and offline as well as evaluate the performance of each channel. To be able to build an effective personalization campaign, the prerequisite for businesses to do is to know what customers like and understand what customers want. From there, give messages as well as develop products based on customer preferences and experience (customer journey). In fact, MSB has applied this in organizing campaigns on holidays such as Valentine’s Day or International Women’s Day, sending personalized messages to customers, showing the bank’s interest in its customers.

Agreeing with Mr. Nguyen Duy Tuong’s view, Mr. Julian Brozoska, CGO of Publicis Groupe once again emphasized: “Marketing must be customer-centric and people-focused”. This activity not only enhances the customer experience but also promotes growth and marketing efficiency for businesses.

In order to develop products, in order to serve a larger number of customers, Ms. Thao Nguyen – Head of Digital Products and Services of VPBank Securities, shared about the use of AI data in digital banking and securities investment applications.

According to Ms. Thao: “VPBank has integrated advanced technology solutions such as AI and Machine Learning on Digital Marketing platforms, Digital Banking applications, and VPBank Securities, helping to personalize the interface and journey of each customer based on spending habits and service usage.”

Despite the challenges, there are good examples of marketing excellence. Looking ahead, the industry anticipates further innovations that promise to redefine the effectiveness and reach of financial marketing in Vietnam’s vibrant economy.

————————————

The event “Executive Dialogues: AI and more” organized by MMA Global Vietnam with the sponsorship of Novaon Digital is an in-depth event exclusively for senior leaders – Executive Dialogues with the participation of big names in the industry. The event took place with the presence of leading experts: Representative of Novaon Digital – CEO Le Viet Hai Son, Ms. Phan Bich Tam – Country Director of MMA Global Vietnam, Myanmar and Cambodia, Mr. Rohit Dadwal – CEO of MMA Global APAC,…

During the program, representatives of businesses participated in in-depth discussion sessions on prominent topics such as:

- Decoding the Role of AI and Big Data in Enhancing Customer Experience and Driving Growth

- Revolutionizing Marketing Performance in Finance & Banking

- Unveiling strategies to leverage digital platforms, social media, and mobile apps to maximize ROI

With in-depth experience and knowledge in the fields of Banking, Finance and Financial Technology – Fintech, the speakers shared their views and perspectives on hot topics and the future of the industry in the digital transformation period, which attracted a lot of attention.