Gen Z has emerged as a powerful force in the financial market, fundamentally reshaping how banks engage with their audience. This generation cares not only about products but also demands personalized experiences, transparency, and genuine interaction. In this context, the integrated Strategy–Creative–Technology model has become a strategic framework for many financial institutions, enabling seamless alignment of strategy, content, and technology to boost communication impact and drive conversions. This article examines standout campaigns in finance and banking that show how the SCT model moves beyond theory to practical, actionable results.

I. Gen Z’s Financial Behaviours Are Redefining Banking

What once looked like a temporary trend is now a transformative shift—Gen Z’s approach to finance is setting a new benchmark for how banks must evolve. For this generation, financial services are as integral to daily life as their smartphones. Institutions that don’t adapt risk being left behind in the digital race.

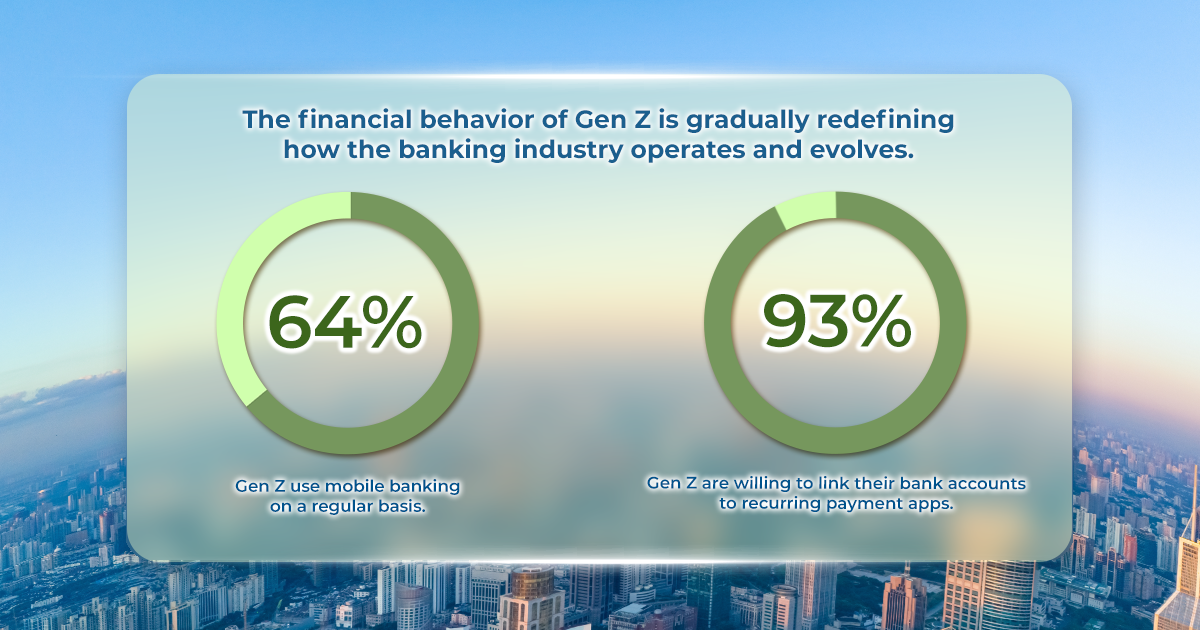

Banking is now part of a lifestyle. When a vast majority of Gen Z are open to linking bank accounts with recurring payment apps and prioritize mobile banking, it becomes clear: digital isn’t a bonus—it is the bank.

Integration and security come first. Convenience alone isn’t enough—Gen Z expects seamless and secure digital experiences. They demand fully integrated platforms that guard personal data meticulously. This means banks must build technology with transparency and advanced security from day one.

Finance = emotional wellbeing. Gen Z prioritizes financial stability over wealth buildup. They see money as a pathway to peace of mind—not just a goal. So financial products must offer reassurance, not just returns.

Short‑term, flexible saving. Though the majority save regularly, only a fraction plan for retirement. Today’s financial products must align with young consumers’ fast-paced goals—whether it’s travel, education, or special purchases.

The financial behavior of gen Z

II. Banking Communications Must Adapt to Gen Z’s Expectations

Gen Z isn’t swayed by traditional branding. They choose banks based on real experiences, transparency in interactions, and emotional relatability. Sleek app interfaces, tailored offers, and content that speaks their language resonate more than polished brand slogans.

Pushy advertising no longer works. This generation seeks authenticity—they trust real feedback on social media and user-generated content over glossy marketing campaigns. Truth matters.

They want timely, unobtrusive information—via apps, social media, and chat channels—not email blasts or on-page banners. Yet they still appreciate in-branch support, if it’s modern and tech-enabled. That’s why “phygital” consistency—online and offline brand experiences—is essential.

Conclusion:

Gen Z’s expectations are not obstacles, they’re opportunities. Financial institutions must listen first, then speak. They need human-centered engagement, authentic storytelling, and technology-enabled personalization. Banks that adapt this way will build genuine loyalty—not just customer base.

III. An Integrated Strategy – Creative – Technology Communication Solution for the Finance and Banking Sector

As users increasingly demand more from their financial experiences—ranging from convenience and personalization to transparency and consistency across every touchpoint—the Strategy – Creative – Technology (S‑C‑T) model has emerged as a comprehensive integrated communication solution, particularly well-suited for the finance and banking industry. Rather than executing disjointed marketing activities, this model enables brands to connect strategy, creative content, and technology into one seamless framework to maximize effectiveness.

In the financial sector—where products are often complex and emotionally distant—communication strategies must put the user at the center. It’s not just about selling products; it’s about building trust and fostering long-term engagement. The S‑C‑T model helps banks deliver the right messages at each stage of the customer journey, enabling them to develop a diverse, easy-to-understand, and contextually relevant content ecosystem—such as tutorial videos, financial infographics, investment advisory content, or human-centered community campaigns.

Technology, on the other hand, plays an indispensable role in measuring, personalizing, and automating user experiences. Banks can integrate chatbots, AI, or automation systems to deliver timely offers, track user journeys in real time, or serve ads to the right audience at optimal cost.

More than just spreading a message, S‑C‑T helps convert engagement into tangible outcomes: from video views to app downloads, from a social post to account sign-ups, or from a brand awareness campaign to actual business conversions. With this approach, communication isn’t just a support tool—it becomes a core pillar of sustainable growth for banks in the digital era.

Clearly, the Strategy – Creative – Technology model is not merely a communication formula—it is an integrated ecosystem that helps financial brands adapt swiftly to market shifts and evolving user expectations. When strategy is well-defined, content speaks the customer’s language, and technology enables personalization, brands don’t just boost reach—they build long-lasting relationships. In a landscape where financial behavior is increasingly complex and varied, applying this model will be key for financial institutions to maintain competitiveness, elevate trust, and steadily cultivate loyalty among the next generation of customers.

Strategy – Creative – Technology

IV. Highlighted S‑C‑T (Strategy – Creative – Technology) Campaigns in the Financial Sector

1. VPBank: Integrated communication to launch TapnPay

When VPBank introduced its mobile contactless payment feature—TapnPay—the challenge wasn’t just bringing a new technology to market, but ensuring users understood, cared about, and actually adopted it. This exemplifies a key issue in finance: even the best products fail if communicated poorly.

To tackle this, the campaign employed a fully integrated communication strategy—from market research and competitive analysis to audience targeting and content planning aligned with user behaviors. Social platforms were leveraged to amplify the message, incorporating carefully chosen KOLs/KOCs and booking high-engagement communities. Notably, the focus wasn’t simply on promoting a new feature but on building a modern, convenient experience tailored to the digital lifestyles of younger customers.

Alongside creative content development, the campaign emphasized measurable impact through KPIs for engagement, views, and reach. A flexible mix of digital tools—media booking, community seeding, and multi‑platform delivery—helped spread the message widely and boost awareness of the new rollout.

The campaign succeeded not only in grabbing attention but also in shifting user perceptions of digital payments—crucial for banks seeking to transform traditional transaction habits. A strategic, responsive, and behavior‑driven approach enabled VPBank to turn a new feature into a valuable touchpoint in users’ banking journeys.

Conclusion:

Through integrated communication, the TapnPay campaign did more than raise visibility—it sparked genuine interest among its target audience. A strategic content approach aligned with digital behaviors and smart platform use yielded clear and impressive outcomes.

Key Results:

- Over 1 million social media interactions

- 126% of view-target KPIs achieved—exceeding goals

- More than 10 million reaches, significantly boosting brand presence

- 187,000 livestream views, driving real-time user engagement

VPBank x Novaon Digital

2. Nam Á Bank: Multi-channel strategy boosting digital financial service awareness

When Nam Á Bank launched its “Surprisingly Fast eKYC – Wave Goodbye to All Fees” campaign, the goal was more than promoting fast account opening—it aimed to spark genuine interest in its broader digital ecosystem, including OpenBanking, OneBank, and credit cards. In a crowded fintech space, the challenge was to make the brand’s message stand out, resonate, and convert.

To address this, the campaign adopted an integrated communication mindset: crafting personalized content across TikTok, Facebook, Instagram, and Zalo, selecting the right KOCs, and seeding across high-engagement pages and groups. The standout aspect was content rooted in relatability—clear, practical messaging focused on the real-life benefits of speed and convenience.

Alongside compelling content, Nam Á Bank invested in media technology with a multi-channel system ensuring constant, targeted message delivery. Tailored landing pages for each product—beautiful account numbers or credit card deals—enhanced conversion rates and guided users seamlessly toward digital banking. The campaign did more than inform—it helped reposition Nam Á Bank as a modern, adaptive financial brand tuned into digital consumer trends.

With a holistic communication approach, Nam Á Bank achieved increased visibility and built an image of a digital-first, customer-aware bank. Though figures weren’t disclosed, there was clear evidence of strong engagement—demonstrating how targeted communication can be a powerful catalyst in the digital banking transformation.

Nam A Bank x Novaon Digital

3. Vietcombank: Integrated rollout of eKYC—simplifying digital account opening

Vietcombank launched its eKYC feature via the VCB Digibank app, enabling customers to open accounts within minutes—no branch visits needed. The challenge lay in communicating a technically complex feature in an approachable way that drives real usage.

The campaign centered around three pillars: strategy, creative, and technology. Strategically, Vietcombank positioned eKYC as a pivotal milestone in its digital journey, deploying cross-channel messaging and collaborating with reputable finance media like CafeF, CafeBiz, and Café Chứng Khoán to enhance credibility. The goals extended beyond awareness to encouraging app installs, account activation, and service use.

Creatively, tutorial videos were designed to be intuitive and easy to follow. Combined with community sharing (via seeding in stock trading groups), the approach generated organic trust and resonated with those who had real needs. Finally, technology drove effectiveness: platform-optimized video formats, real-time tracking, and intelligent budget allocation ensured messages reached the right people at the right time.

Conclusion:

Vietcombank’s eKYC campaign demonstrates how integrated communication can change user behaviors. Beyond launching a new feature, it positioned the bank as a leader in digital transformation. With strategy, creative content, and technology working together, the campaign not only made noise—it built trust and drove sustainable user adoption.

Key Results:

- Significant increase in app visits and eKYC account openings

- 30% growth in social media engagement, amplifying reach

- Extensive coverage by credible financial channels, strengthening brand trust

Vietcombank x Novaon Digital

Conclusion

In the digital era—where user behaviors shift daily and personalized experiences take center stage—the financial and banking sector must undergo transformation to maintain relevance and forge meaningful connections with customers. The S-C-T model is not merely a communication framework, but a comprehensive mindset that enables brands to communicate more intelligently, creatively, and effectively.

When strategy is properly aligned, content resonates emotionally, and technology is applied flexibly, banks are no longer just service providers—they become trusted financial companions in every customer’s life journey. This is how communication moves beyond grabbing attention to building trust—the most valuable and enduring asset in today’s financial landscape.