This article is based on the “Industry Snapshot: Consumer Packaged Goods” report by WARC, combined with expert insights from Novaon Digital, to provide a concise and comprehensive overview of the key trends each sector will face. It also highlights critical macroeconomic factors shaping marketing strategies within the packaged goods industry in 2025. Additionally, Novaon Digital offers practical recommendations to help CEOs, CMOs, and C-level executives effectively navigate these challenges.

Industry Landscape: How Can Brands Achieve Sustainable Growth and Meet Expectations?

The Consumer Packaged Goods (CPG) industry is undergoing profound transformations due to macroeconomic trends and shifts in global consumer behavior. How can brands transition toward a strategy for sustainable growth? Below is an overview of the industry.

Top 10 Most Valuable Food & Beverage and Non-Alcoholic Beverage Brands

Based on Brand Finance’s 2023 brand valuation ranking for the food sector, we can identify several key takeaways:

- The U.S. dominates the Top 10, with five brands making the list (Lay’s, Tyson, Kellogg’s, Quaker, and Wrigley). This highlights the strength and diversity of American food brands.

- China has a strong presence: Besides Yili, both Mengniu (USD 6.005 billion) and Haitian (USD 6.235 billion) are also featured, reflecting China’s growing role in the global food industry.

This ranking illustrates the widespread distribution of leading food brands worldwide, with notable dominance from the U.S., China, and Europe. Moreover, the food & beverage industry is not only thriving in traditional markets but also experiencing robust growth in emerging economies such as China. The competition in this industry continues to intensify, requiring brands to stay agile and innovative.y đòi hỏi các thương hiệu phải liên tục đổi mới để duy trì vị trí của mình.

Brand Value Ranking of Food and Beverage Brands (Source: WARC 2024)

Beyond the food sector, the 2023 Brand Finance brand valuation ranking for beverages and non-alcoholic beverages reveals key industry insights:

- Coca-Cola maintains its unrivaled dominance, topping the ranking with a brand value of $33.468 billion, significantly surpassing Pepsi ($18.355 billion). This reinforces Coca-Cola’s position as the undisputed global leader in both brand recognition and commercial value. Despite the substantial gap, Pepsi remains its primary competitor, continuing to challenge Coca-Cola’s stronghold.

- The United States leads the market, with six out of the top ten brands originating from the country—further solidifying its status as a global powerhouse in the beverage industry. The energy drink segment is experiencing remarkable growth, with Red Bull, Monster, Gatorade, and Dr Pepper emerging as key players. Simultaneously, Asian and European brands, including Nescafé, Nongfu Spring, and Lipton, are making significant strides, reflecting the industry’s increasing globalization and product diversification.

Non-Alcoholic Beverage Brand Value Ranking (Source: WARC 2024)

Top 10 Most Valuable Cosmetics Brands

The cosmetics category is led by L’Oréal (France), which dominates the market with a brand value of $13.384 billion. The ranking highlights the continued market dominance of U.S. cosmetics brands, reinforcing their stronghold in the global beauty industry.

Meanwhile, Lancôme, Pantene, Garnier, and Maybelline have demonstrated strong growth trajectories, with a steady upward trend in brand value, signaling their increasing influence and expanding market share.

Cosmetics Brand Value Ranking (Source: WARC 2024)

Advertising Spending Trends of Leading Brands

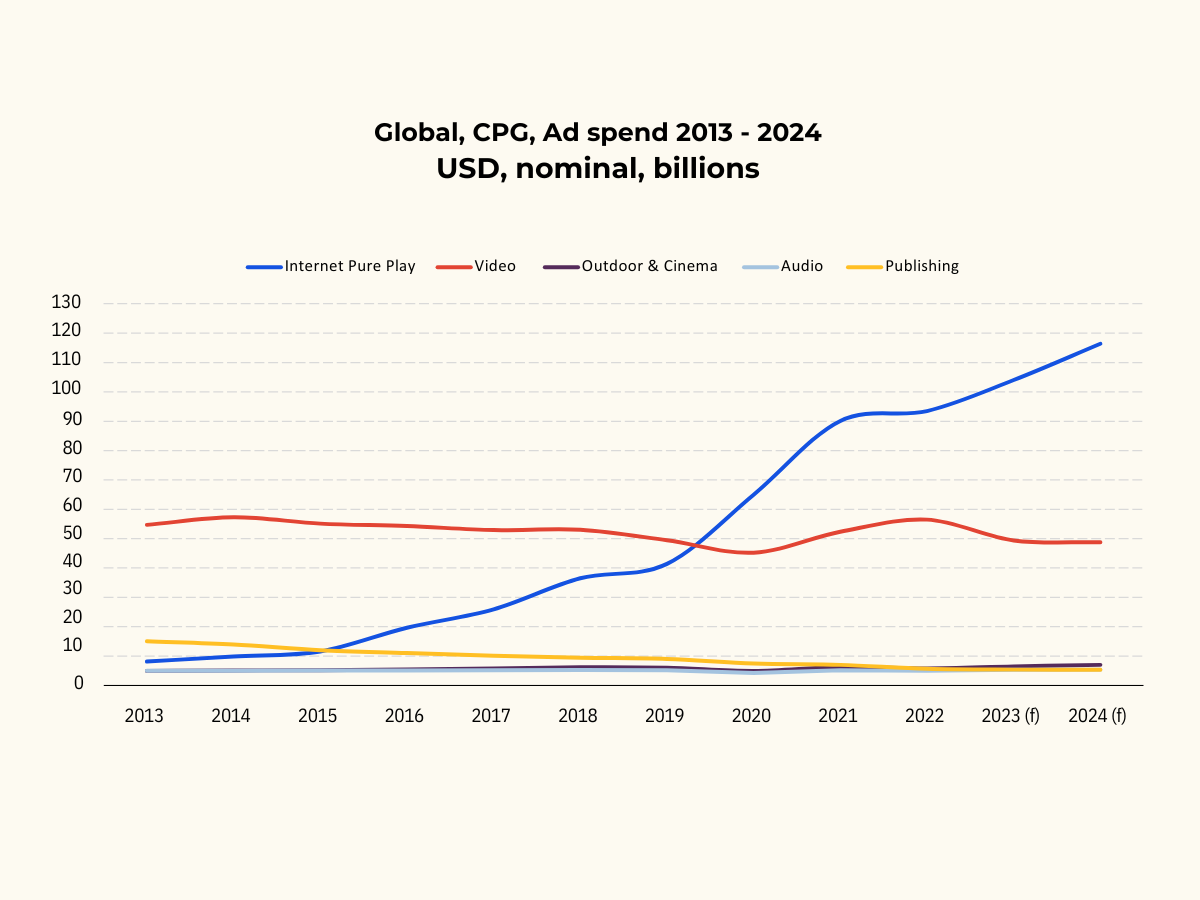

According to WARC Media, total advertising expenditure for the Consumer Packaged Goods (CPG) sector is projected to reach $182.8 billion in 2024, up from $170.5 billion in 2023, reflecting an annual growth rate of 7.2%.

Notably, nearly two-thirds (64%) of this total ad budget is expected to be allocated to digital-first advertising platforms. Meanwhile, investments in traditional advertising channels are anticipated to remain relatively stable, with minimal fluctuations.

Global Advertising Expenditure in the Consumer Packaged Goods Sector (Source: WARC 2024)

Trends Shaping the Future of the Consumer Packaged Goods (CPG) Industry

The Consumer Packaged Goods (CPG) Industry Undergoing a Major Transformation

The CPG sector is shifting from price-driven growth to sustainable development, as consumers reach their spending limits in a cooling inflationary environment. Health-conscious trends, particularly in anti-aging products, are driving innovation.

Meanwhile, Generation Alpha is increasingly influencing purchasing decisions, especially in the food and cosmetics industries. The rising popularity of weight-loss drugs such as Ozempic and Wegovy is also altering consumer habits. Additionally, sustainability has become a key priority, with brands adopting waste-reduction initiatives, such as repurposing surplus materials. These trends are set to shape the future of the CPG industry.

Trend 1: Reshaping Price-Driven Growth

With inflation slowing and consumers reaching their limits on price increases, CPG brands are re-evaluating their price-based growth strategies

What’s happening

Since 2021, commodity prices have surged due to higher input costs, yet corporate profit margins have expanded significantly. According to Groundwork Collective, corporate profits accounted for 53% of U.S. inflation in Q2-Q3 2023, compared to just 11% pre-pandemic.

As inflation stabilizes, companies are moving away from aggressive price hikes. Deloitte reports that only 2% of CPG executives prioritize price increases in their growth strategies. The key challenge now is maintaining profit margins as economic conditions normalize.

What’s driving this trend

- Consumer Price Sensitivity: Rapid price increases over the past few years have triggered a cost-of-living crisis, prompting 47% of consumers to switch products, retailers, or experiment with new brands—nearly double the rate recorded in 2021.

- Regulatory Scrutiny: Governments worldwide are tightening price regulations. In Australia, the ACCC has launched an investigation into supermarket pricing and competition.

- Retailer Pushback: While many retailers have passed rising costs onto consumers, 40% of CPG executives expect retailers to resist further price increases in 2024. Carrefour has already stopped selling PepsiCo products, citing “unacceptable” price hike demands.

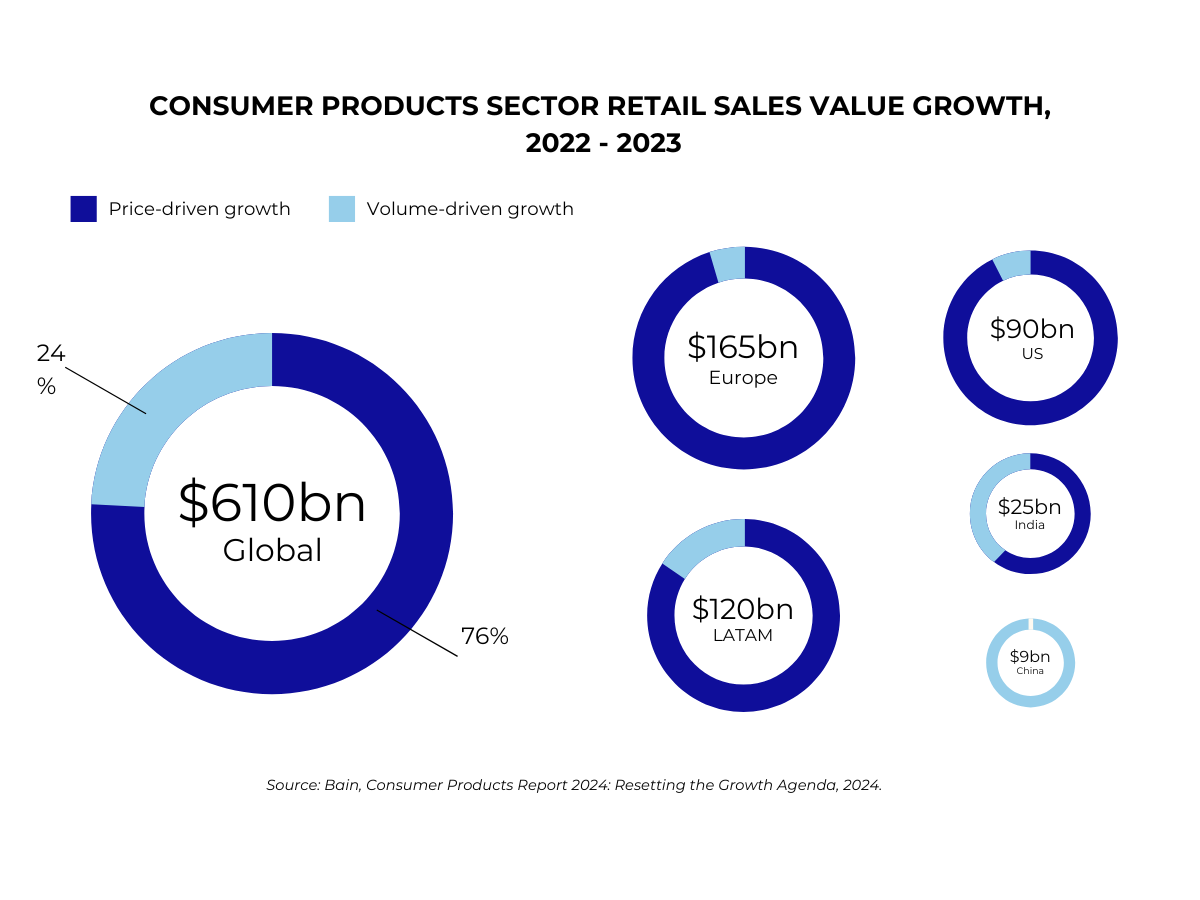

Pricing Growth Drove Three-Quarters of 2023 Industry Gains

According to Bain & Company, global CPG retail sales grew by nearly 10% in 2023 compared to the previous year. Of this growth, 76% stemmed from price increases, while only 24% resulted from volume expansion.

The disproportionate impact of price-driven growth has been particularly evident in Europe and the U.S., where price hikes contributed 95% and 92%, respectively, to revenue growth.

Retail Sales Value Growth Chart for the Consumer Packaged Goods Industry (2022-2023) (Source: WARC 2024)

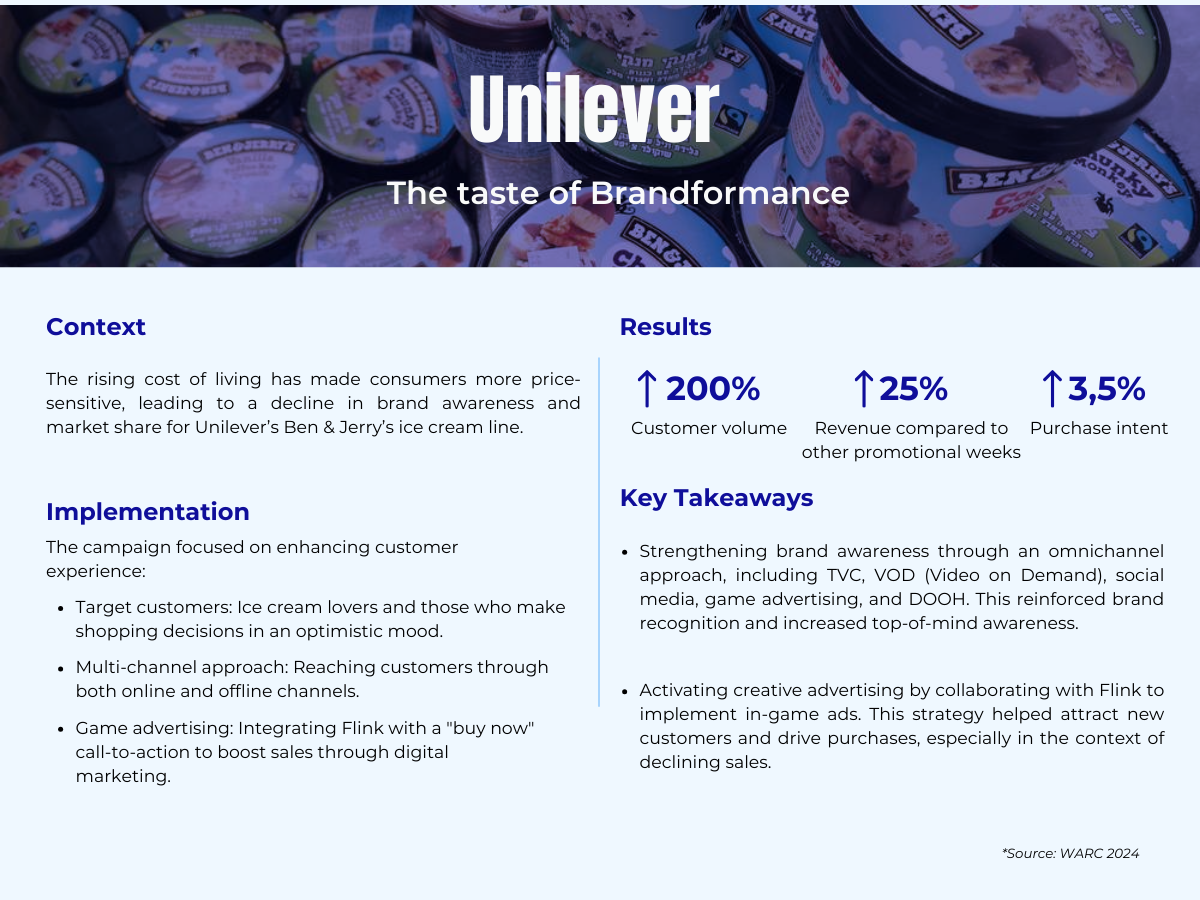

Casestudy Uniliver: Brandformance Strategy Enhancing Brand Experience

How marketers can respond

Trend 2: Healthy Aging – Shaping New Consumer Behaviorới

Consumers are increasingly prioritizing healthy aging, driving brands to introduce innovative products that address health concerns associated with the aging process.

What’s happening

The World Health Organization (WHO) predicts that by 2030, one in six people will be over 60 years old, making healthy aging a key global priority. In the UK, the number of cities committed to improving the well-being of individuals aged 50 and above has surged from 33 in 2020 to 79 in 2024.

Consumer interest in healthy aging is rapidly increasing: 85% of consumers in China and 70% in the UK & US are now purchasing more aging-supportive products than before. According to McKinsey, this trend extends beyond older adults, as younger generations are also seeking preventive health solutions.

Within the CPG sector, the functional food and beverage segment supporting healthy aging has seen a 14% CAGR growth (2018-2022). The industry is expected to further refine its product offerings to meet evolving consumer demands.

What’s driving this trend

- Increasing Life Expectancy: According to the Global Burden of Disease Study 2021, the global average life expectancy is projected to rise by five years from 2022 to 2050, fueling investments in healthy aging solutions and empowering older consumers.

- Shift Towards Preventive Healthcare: Consumers are increasingly treating nutrition as a proactive health tool. A Deloitte survey found that 40% of consumers prioritize fresh foods for maintaining health, while IFIC data indicates that one-third of consumers have changed their diets to enhance long-term well-being.

- Innovation from Major Brands: Leading CPG companies are accelerating innovation to cater to aging consumers. Nestlé has launched products supporting healthy aging, while Hershey has expanded its portfolio with sugar-free, high-protein, and plant-based options.

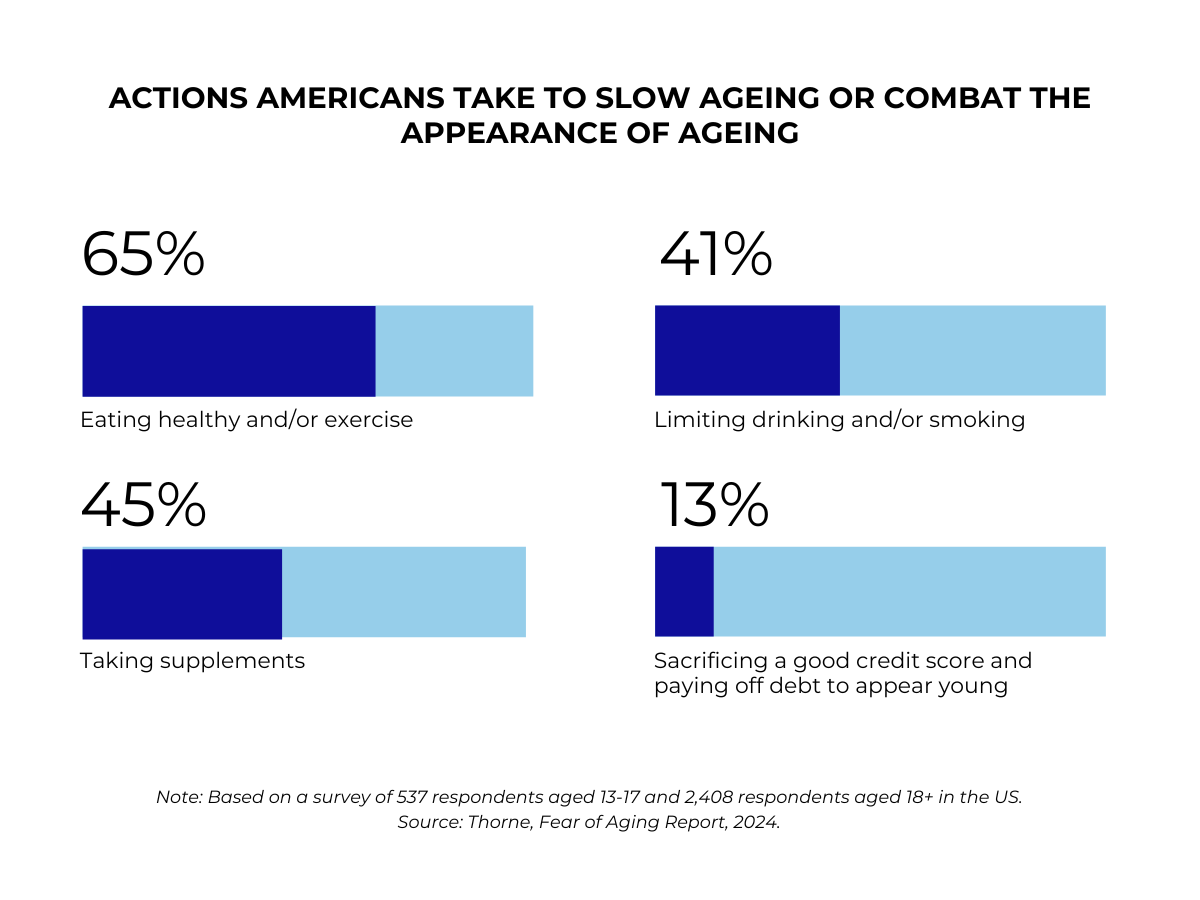

Rising Consumer Demand for Anti-Aging Nutrition

Approximately 65% of Americans now prioritize healthy eating and regular exercise as a means to prevent aging-related issues. Additionally, 45% of surveyed consumers reported using dietary supplements, while 41% have reduced alcohol consumption or smoking to safeguard their long-term health.

According to IFIC research, consumer interest in foods, beverages, and nutrients supporting healthy aging has grown by 40% compared to 2023. This trend is particularly prominent among Baby Boomers (52%) and Gen X (38%), underscoring a widespread shift toward longevity-focused consumption habits.

Methods Americans Use to Slow Down Aging (Source: WARC 2024)

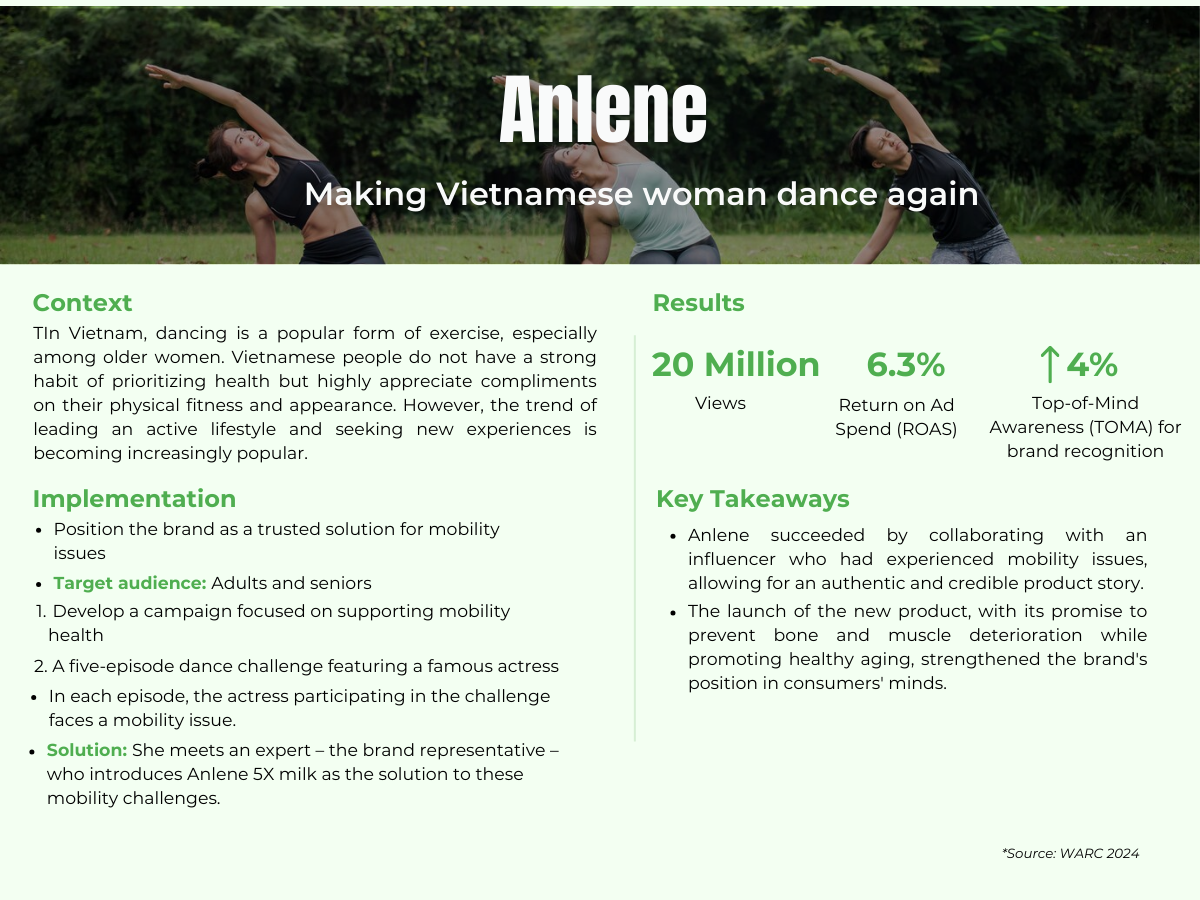

Case Study Anlene: Inspiring Vietnamese Women to Dance Again

How marketers can respond

Trend 3: Generation Alpha – The Young Consumers Shaping the Future Market

Generation Alpha, born between 2010 and 2024, is increasingly exerting strong influence over household purchasing decisions, particularly in food, cosmetics, and skincare industries.

What’s happening

With nearly 2 billion individuals by 2025, Generation Alpha is growing rapidly, particularly in India, China, and Nigeria, and is significantly shaping family spending habits.

In beauty and skincare, the rise of the “Sephora Kid” trend reflects an early interest in skincare routines, raising concerns about product suitability for young skin and prompting brands to be more cautious in their marketing strategies.

In the food sector, nearly 50% of parents report that their children (aged 7 and above) request specific brands.

What’s driving this trend

- Encouraging Decision-Making Skills: Parents of Generation Alpha actively promote critical thinking, emotional intelligence, and independence, allowing children to participate in purchasing decisions and daily choices.

- Generation Alpha’s High Brand Awareness:56% of parents state that their children frequently watch shopping-related content such as haul and unboxing videos, giving them early exposure to various brands.

- The Rise of Young Influencers:79% of Millennial parents confirm that their children use social media, fostering the emergence of Gen Alpha influencers such as Evelyn, Garza Crew, and North West, who are shaping market trends.

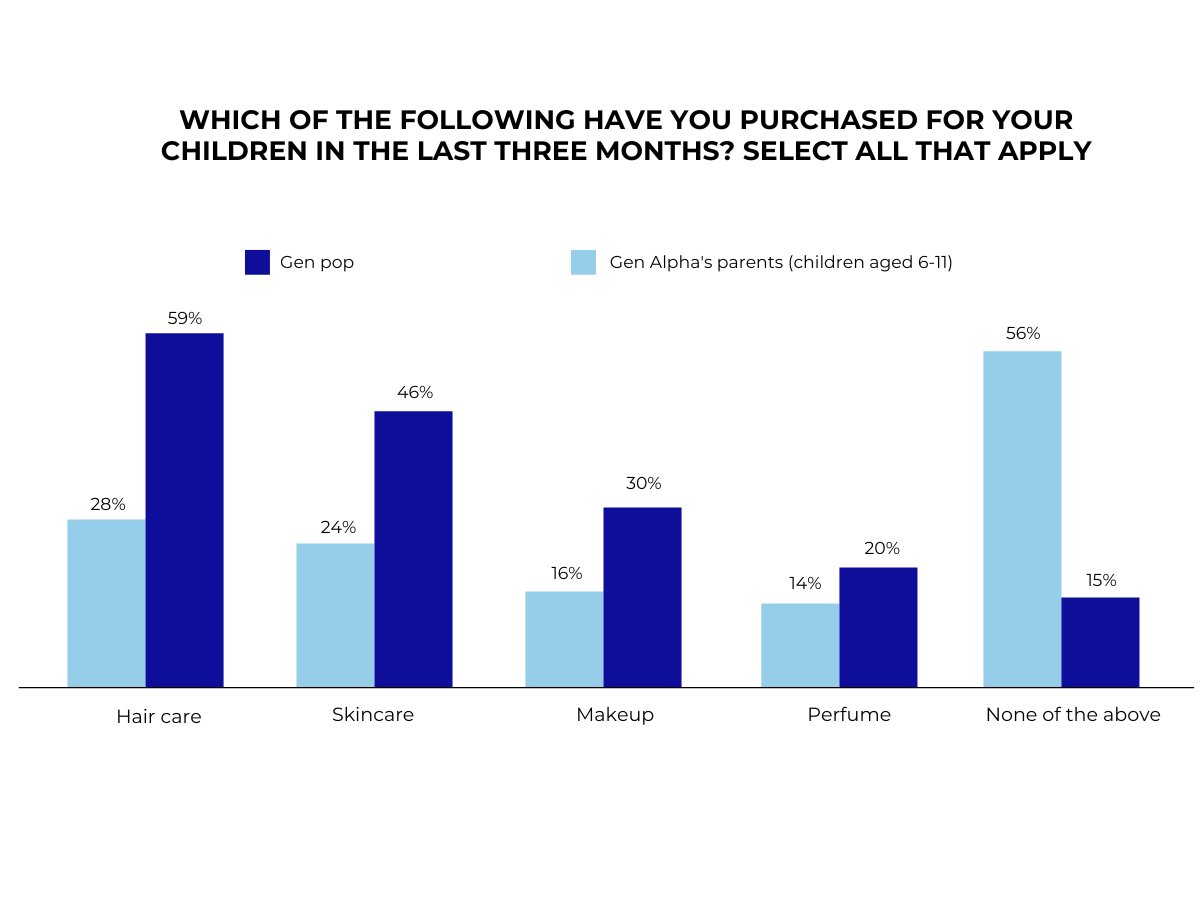

Nearly Half of Generation Alpha Parents Have Purchased Skincare Products for Their Children

Parents of Generation Alpha are spending more on haircare, skincare, and makeup products for their children over the past three months compared to the general U.S. population.

Survey data highlights popular brands among Generation Alpha parents, including E.L.F. Beauty, Sol de Janeiro, and Drunk Elephant. Notably, in 2023, Drunk Elephant, a high-end skincare brand, introduced specialized recommendations for young consumers, reflecting the increasing demand for age-appropriate skincare solutions.

Products Consumers Have Purchased for Their Children in the Past Three Months (Source: WARC 2024)

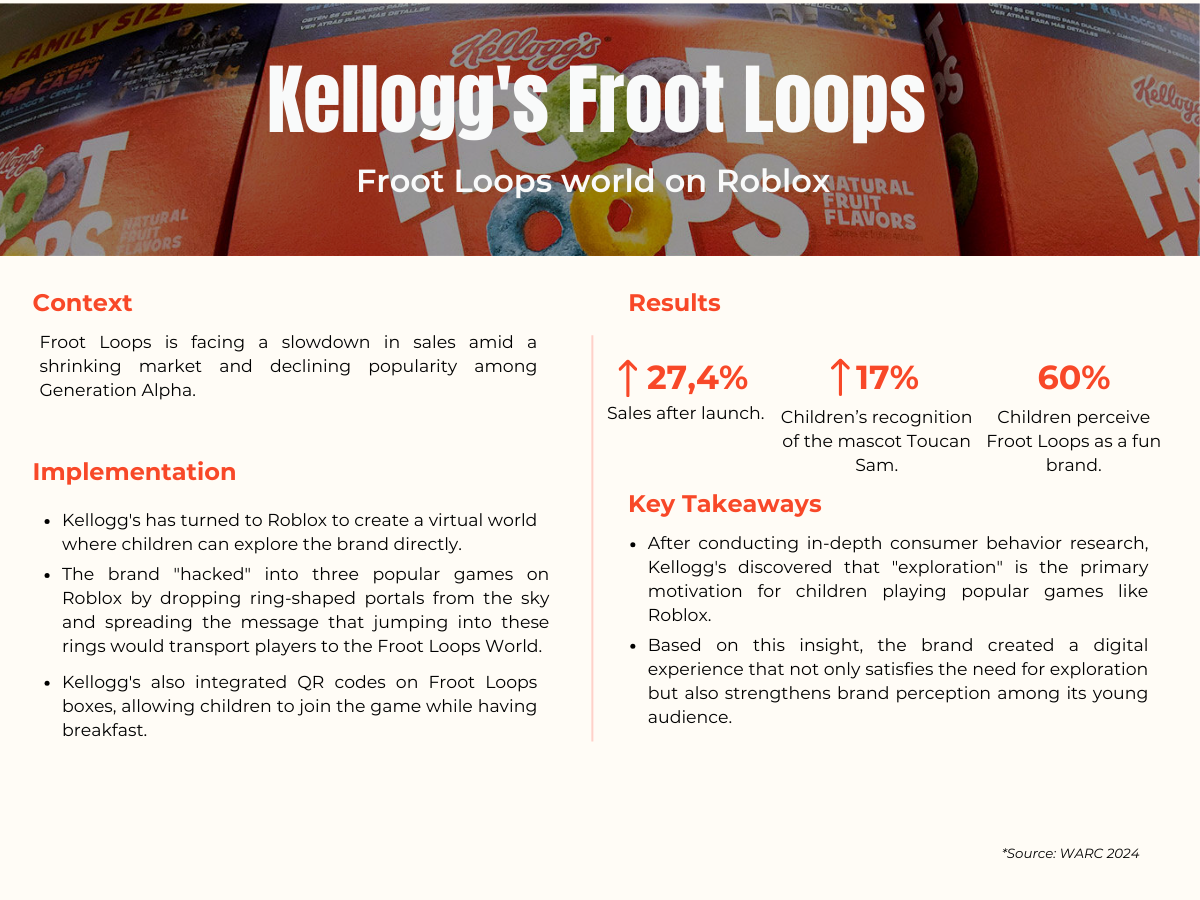

Casestudy Kellogg’s Froot Loops: Kellogg’s Froot Loops – The Froot Loops World on Roblox

How marketers can respond

Trend 4: The Surge in Weight Loss Drugs – Reshaping Consumer Demand and Eating Habits

The rising popularity of weight loss medications like Ozempic and Wegovy is prompting several consumer packaged goods (CPG) brands to reevaluate and adjust their product portfolios to align with evolving consumer needs and eating habits.

What’s happening

GLP-1 medications such as Ozempic, Wegovy, and Mounjaro aid in blood sugar regulation, slow digestion, and suppress appetite, significantly impacting eating behaviors and food and beverage sales.

According to Morgan Stanley, the consumption of soft drinks, alcohol, and snacks could decline by 4% by 2035 as weight loss drug users reduce their food intake. The industry’s response varies:

- Coca-Cola and PepsiCo are closely monitoring the trend before making strategic adjustments.

- Nestlé is developing nutrient-enriched frozen meals tailored for weight loss drug users.

What’s driving this trend

- Expanding Weight Loss Drug Market: Valued at $3.83 billion in 2023, the weight loss drug market is projected to reach $44.12 billion by 2029 (CAGR >50%). Pharmaceutical companies in China and India are developing affordable alternatives to enhance accessibility.

- Changing Consumer Behavior: GLP-1 drugs reduce cravings, leading users to purchase 8% less food than the average consumer (J.P. Morgan).

- New Revenue Opportunities: The side effects of weight loss drugs are driving demand for high-protein foods to mitigate muscle loss

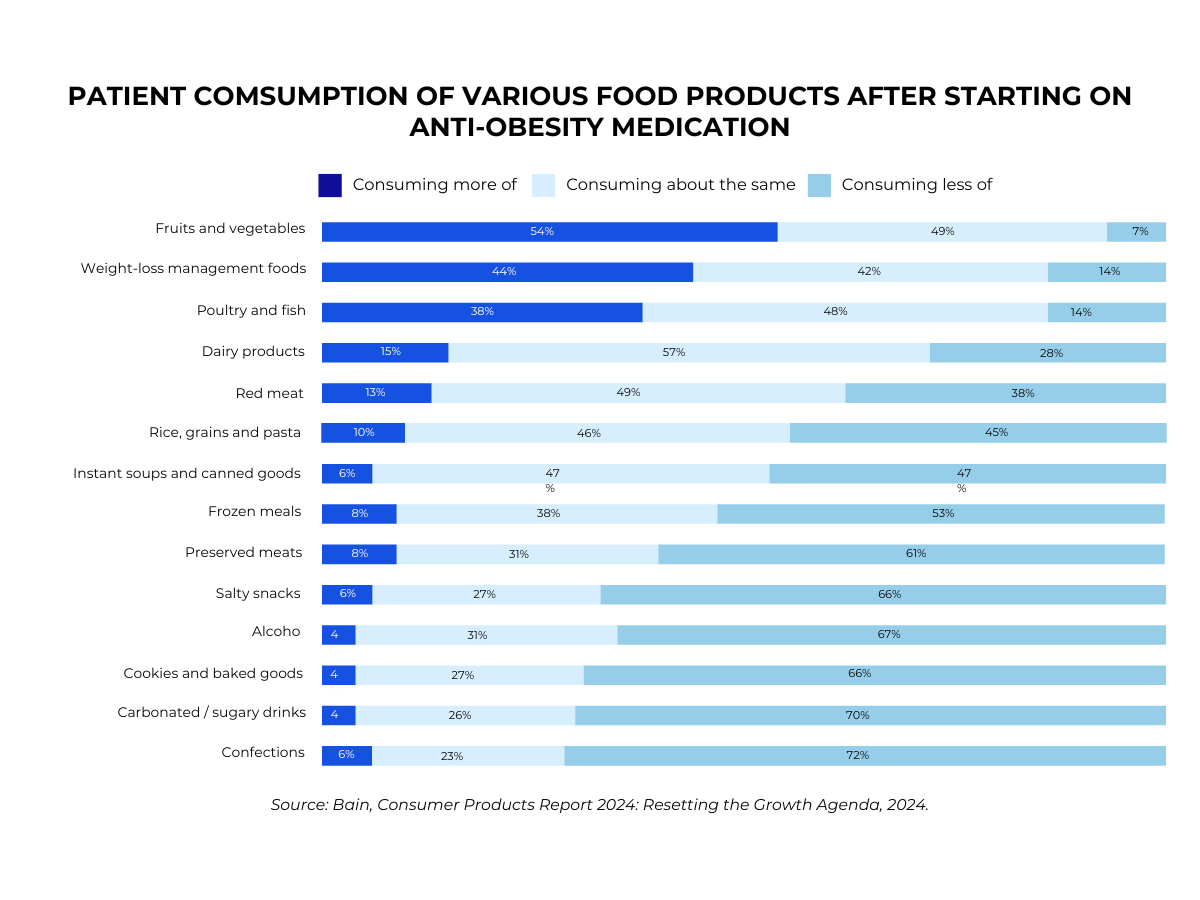

Rise of Healthier Food Choices

According to Morgan Stanley Research, patients using anti-obesity medications (AOMs) tend to increase their consumption of healthier foods, such as fruits and vegetables, after beginning treatment. Additionally, demand for meal replacement products, including protein shakes and nutrition bars, has also risen.

Conversely, consumption of traditional processed foods and calorie-dense snacks is witnessing a notable decline, signaling a fundamental shift in the food and beverage industry’s landscape.

Consumption Levels of Various Food Categories After Using Anti-Obesity Medications (Source: WARC 2024)

- Casestudy Complan: Rotate the Product Box to Discover the Difference

How marketers can respond

Trend 5: Food Upcycling – Transforming Waste into High-Value Products

The growing concern over food waste has driven brands to repurpose by-products, surplus ingredients, and excess food into value-added products, aligning with both sustainability goals and consumer expectations.

What’s happening

Every year, $1 trillion worth of food is wasted, contributing to 8–10% of global greenhouse gas emissions (UNEP). With rising consumer awareness and high raw material costs, businesses are shifting towards more sustainable sourcing solutions.

The food upcycling movement is gaining momentum, turning food by-products into premium products. The upcycled food market is projected to reach $97 billion by 2031 (CAGR 6.2%). Additionally, nearly 40% of consumers (New Hope Network) are willing to pay a premium for upcycled products.

What’s driving this trend

- Consumer Expectations: 39% of consumers have already recycled or reused products to protect the environment, but 61% believe brands must do more to tackle food waste (Capgemini).

- Innovative Upcycled Products: Leading brands are expanding their sustainable product portfolios. For instance, Nestlé repurposes coffee fruit husks to create new coffee products, while LG H&H develops beauty brands using discarded raw materials.

- Food Waste Reduction Initiatives: The Consumer Goods Forum launched the #TooGoodToWaste campaign, raising awareness, providing waste-reduction guidelines, and urging brands to take action across the supply chain.

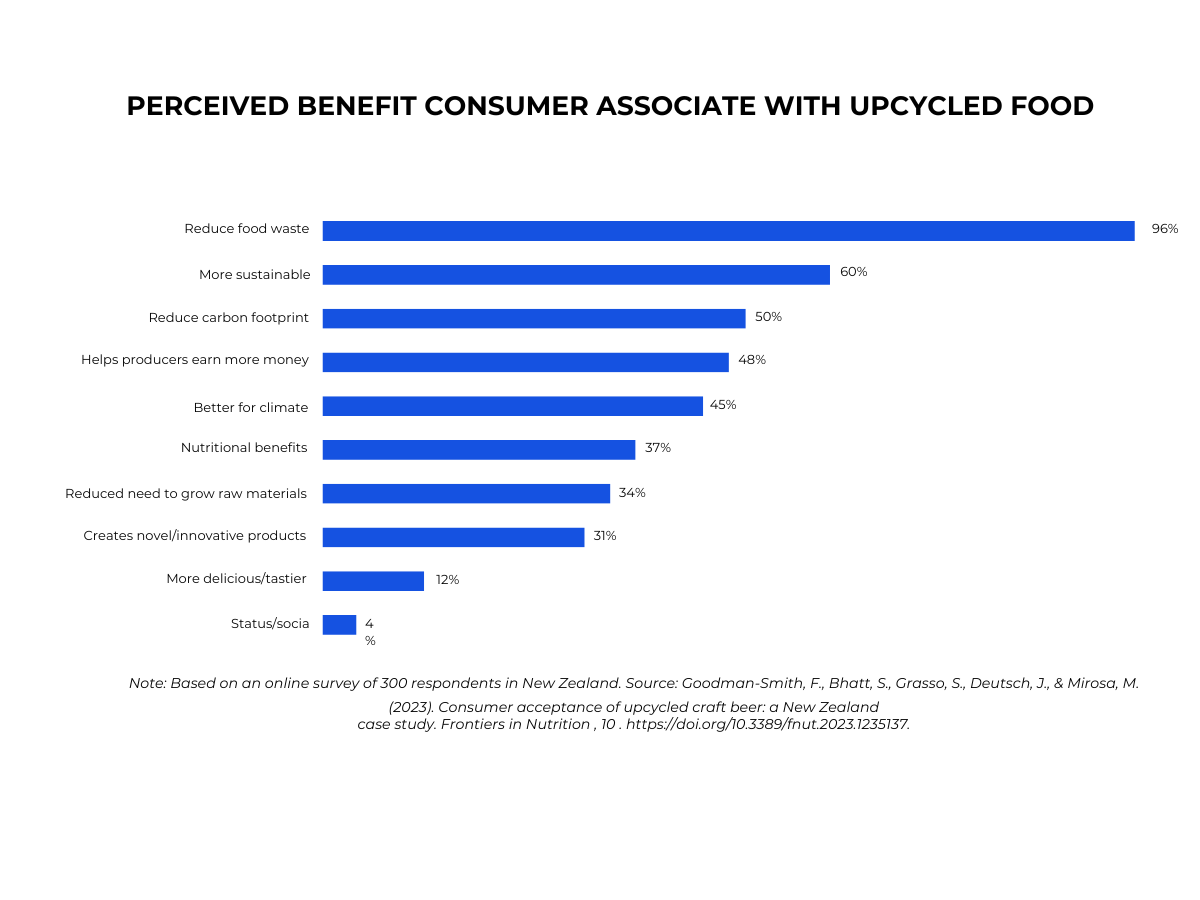

Recycling is associated with environmental benefits.

Consumers highly value upcycled foods due to their environmental benefits:

- 96% believe they help reduce food waste.

- 60% consider them a sustainable choice.

- 50% associate them with a lower carbon footprint.

Transparency remains crucial, with 60% of consumers demanding clearer information on sourcing and processing methods. Brands that embrace transparency and sustainability will gain a competitive edge in this evolving market.

Consumer Benefits of Using Upcycled Food (Source: WARC 2024)

Casestudy Makro: Life extending stickers

How marketers can respond

Future Potentials

Scenario planning is a strategic method that enables businesses to anticipate and prepare for potential future developments.

Globally, an increasing number of companies across various industries are integrating scenario planning into their strategic processes. This approach not only drives growth but also enhances business agility, enabling organizations to adapt effectively to unexpected market shifts.

Based on the trends outlined in this report, the following hypothetical scenarios serve as a starting point for marketers to engage in discussions and develop tailored scenario plans.

Governments Tighten Regulations on Advertising Targeted at Children

- Why This Could Happen

This year, the European Union (EU) has issued a complete ban on targeting advertisements at minors based on their personal profiles or personal data.

Amid growing concerns about Generation Alpha’s obsession with skincare products, a major pharmacy chain has prohibited children from purchasing anti-aging products. At the same time, summer camps have also advised children not to bring skincare products with them.

- Potential Consequences

CPG brands targeting young consumers may face significant challenges in reaching their audience.

Reduced exposure to advertising could weaken children’s influence on household purchasing decisions, leading to shifts in buying behavior.

- Considerations for marketers

Brands may need to pivot their marketing strategies, focusing on parents as a primary decision-making audience.

Governments worldwide may implement varying policies on child-directed advertising, requiring brands to closely monitor and adapt to evolving regulations when expanding into different markets.

Popular Weight Loss Drugs Are Found to Have Severe Side Effects, Leading to Consumer Distrust

- Why This Could Happen

Some weight loss drugs have been flagged for potential side effects. For instance, a condition known as “Ozempic face” has been linked to GLP-1 medications, causing facial changes such as wrinkles and sunken eyes.

Additionally, a recent study suggests that individuals using Ozempic or Wegovy may face a higher risk of developing a rare but serious eye condition.

- Potential Consequences

Consumers may shift to traditional weight loss methods such as exercise and maintaining a healthy diet. Brands risk facing significant financial losses due to declining sales, product recalls, and even legal lawsuits.

The approval process for weight loss drugs may become more stringent with the increase in stricter regulations.

- Considerations for marketers

Products originally designed to support weight loss drugs may need to be adjusted and improved to meet the evolving demands of the market.

Brands should provide clear information about the potential side effects of weight loss drugs and explain how these effects may impact their products (if applicable). Customer service teams must be well-equipped with knowledge to effectively address consumer questions and concerns.

Lab-Grown Meat Advances to Mass Production and Large-Scale Commercialization

- Why This Could Happen

The growing consumer demand for sustainable food and concerns about animal welfare have driven the emergence of alternatives to traditional livestock farming.

Government and regulatory support have facilitated the rapid growth of the alternative protein industry. Lab-grown meat, also known as cultured meat, has been approved for consumption in several countries, including Singapore and the U.S.

- Potential Consequences

Consumers may shift to cultured protein alternatives, which could impact meat product sales and reduce market share for businesses in the industry.

The rising popularity of lab-grown meat may increase consumer awareness of sustainability while also putting pressure on businesses to uphold environmental responsibility. Companies that fail to meet customer expectations may be excluded from consumers’ purchasing choices.

- Considerations for marketers

Brands introducing lab-grown meat may face initial resistance from hesitant customers. Therefore, it is essential to implement strategies to educate consumers on the benefits of cultured meat and help them become more comfortable with its consumption.

As consumers increasingly focus on food production processes, emphasizing transparent, sustainable, and ethical supply chain practices will play a crucial role in building trust and providing reassurance to customers.

Conclusion

In the ever-evolving consumer packaged goods (CPG) industry, understanding and adapting to key trends are crucial for business success. Shifts in consumer behavior, technological advancements, and macroeconomic factors will continue to shape marketing strategies in 2025.

Novaon Digital takes pride in being a specialized consultancy in brand experience solutions, dedicated to fostering sustainable brand growth and driving revenue. Through the insights in this article and recommendations from Novaon Digital, CEOs, CMOs, and senior leadership teams can develop agile marketing strategies, optimize resources, and enhance their competitive edge. Businesses must not only embrace innovation but also adopt a proactive mindset to navigate challenges and capitalize on market opportunities.

Explore more of Novaon Digital’s FMCG solutions here.

*Source: Brandsvietnam