30% of consumers surveyed said that shopping spending in 2024 will increase compared to 2023, while over 40% of consumers said they will continue to cut back on shopping, and 30% of consumers said that there will be no change in shopping compared to 2023. According to the results of a survey on the level of consumer shopping by the Vietnam Association of High-Quality Goods Enterprises, compared to last year in 2024, the level of shopping has a more optimistic signal, but the increase is not significant.

The problem for consumer electronics businesses is what to do in the face of the complicated situation of the market as well as changes in domestic consumer behavior trends.

1. Overview of the consumer electronics industry

a. Access to Consumer Electronics

Consumer electronics include electronic devices that serve the daily needs of consumers. The Consumer Electronics industry includes 2 main industries: Electronics (phones, computers, electronic devices…) and Household appliances (kitchen equipment, cooling, cleaning, etc.). For each category, the products have different characteristics, specifically:

Products in the electronics industry are characterized by short life cycles, continuous innovation, and trend-following. Consumers are mainly from 18-35 years old, with a preference for updating technology trends and dynamic behavior on social networks. Electronic products are widely consumed on special occasions such as the Tet season, the tourist season, the new product launch season, the back-to-school season, and the festival season.

On the contrary, the product life cycle is long, there is little fluctuation in features and designs, and customers are more interested in quality, durability, energy saving, etc. are the characteristics of the household electrical industry. These products can be consumed at any time of the year, seasonality is evident in products such as air conditioners, fans, refrigerators (consumed mainly in summer) and heaters, heating fans, clothes dryers (consumed in winter).

The role of consumer electronics is diverse, not only improving the quality of life but also promoting technological development, creating jobs and stimulating the economy. These products help connect people, support work and entertainment, personal communication, and enhance utility and efficiency in daily life.

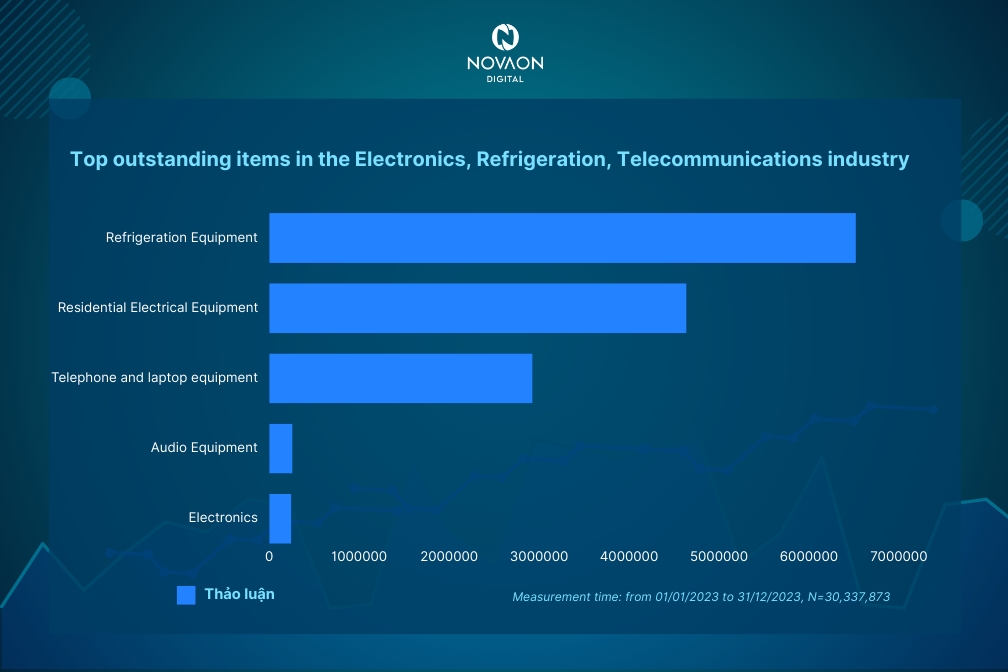

To better understand the industry, as well as see the performance of each specific product group, let’s take a look at the ranking below:

Refrigeration equipment is the most talked about item in 2023, accounting for 36% of the total discussion in the Electronics, Refrigeration, and Telecommunications industry. The top popular brands on social networks are Dien May XANH, FPT Shop, Mobile World, Viettel Store and Hoang Ha Mobile. The Electronics and Refrigeration retail industry is an “ideal playground” for big brands. In particular, Mobile World and Dien May XANH of Mobile World Joint Stock Company are still the 2 most chosen brands to buy in 2023, according to a report by YouGov BrandIndex.

b. Category statistics on the e-Commerce channel

Grasping the development trend of e-commerce channels, consumer e-commerce businesses expand their business through official online sales channels or booths on e-commerce platforms Shopee, Tiktok, Tiki, Lazada, etc.

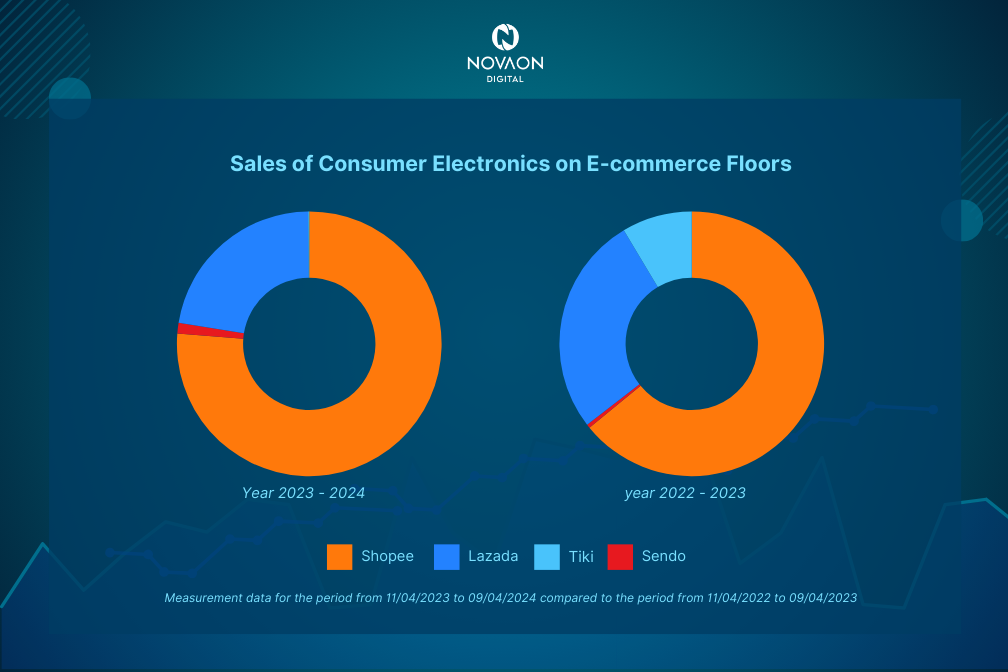

The Consumer Electronics industry has great growth. Shopee is still the Top 1 e-commerce platform, this is the largest consumer electronics brand to focus on. The largest allocation of Consumer Electronics revenue on e-commerce platforms is Shopee with 76.8%, followed by Lazada with 21.9%, the rest is allocated to Sendo and Tiki (excluding TikTok Shop).

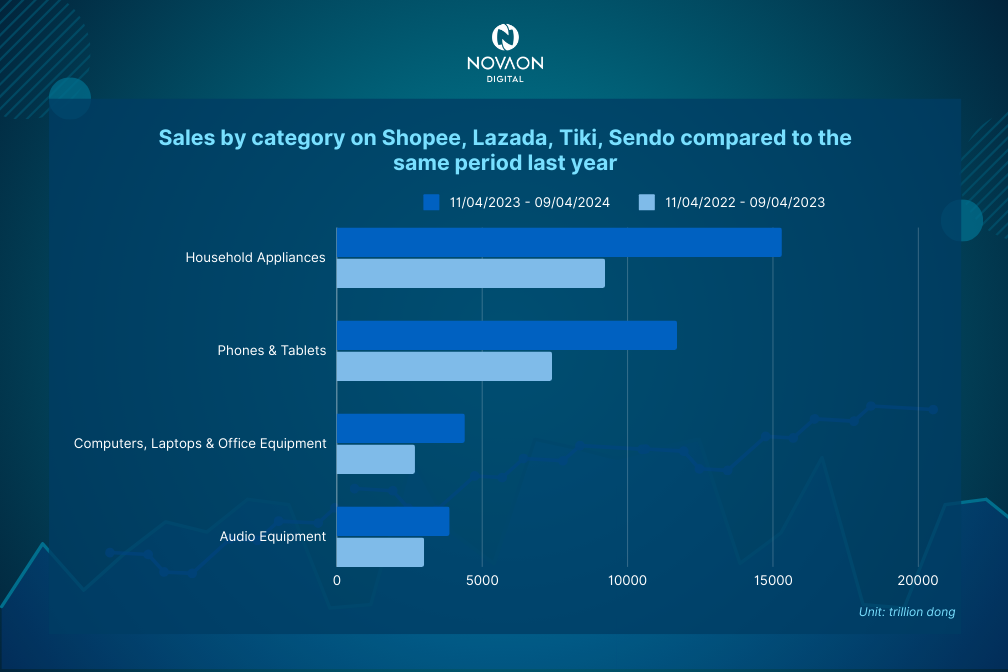

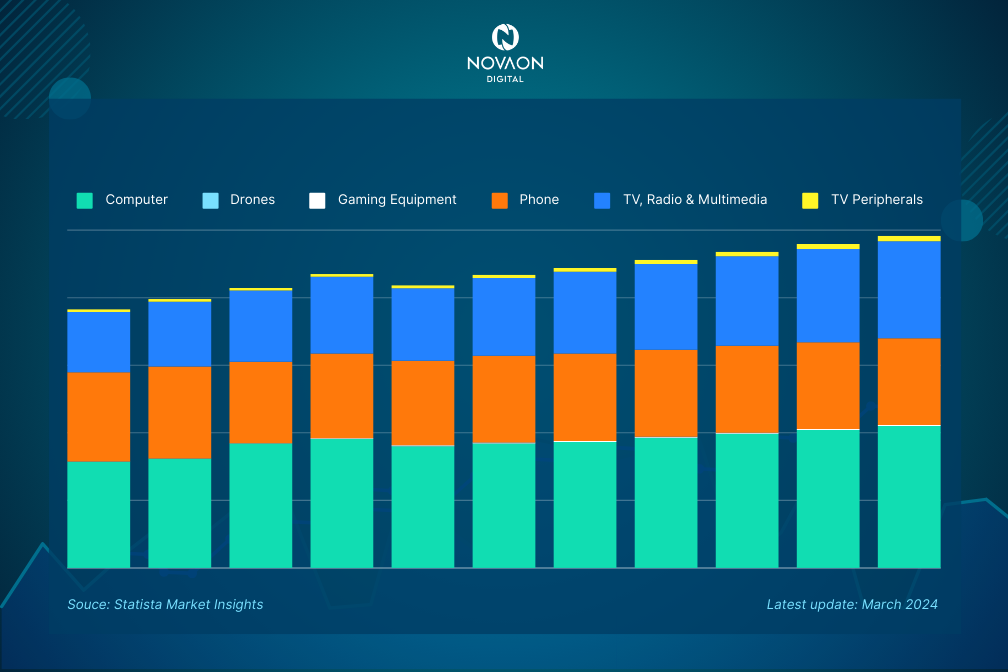

In 2023, Household Appliances is the industry with the highest revenue in the Consumer Electronics industry (~15 trillion VND), up ~6 trillion VND over the same period in 2022. In 2nd place is Phones & Tablets, with revenue of about ~12 trillion VND, an increase of more than 4 trillion VND over the same period in 2022. These are the 2 industries that account for the largest market share of the entire Consumer Electronics industry on the e-Commerce floor.

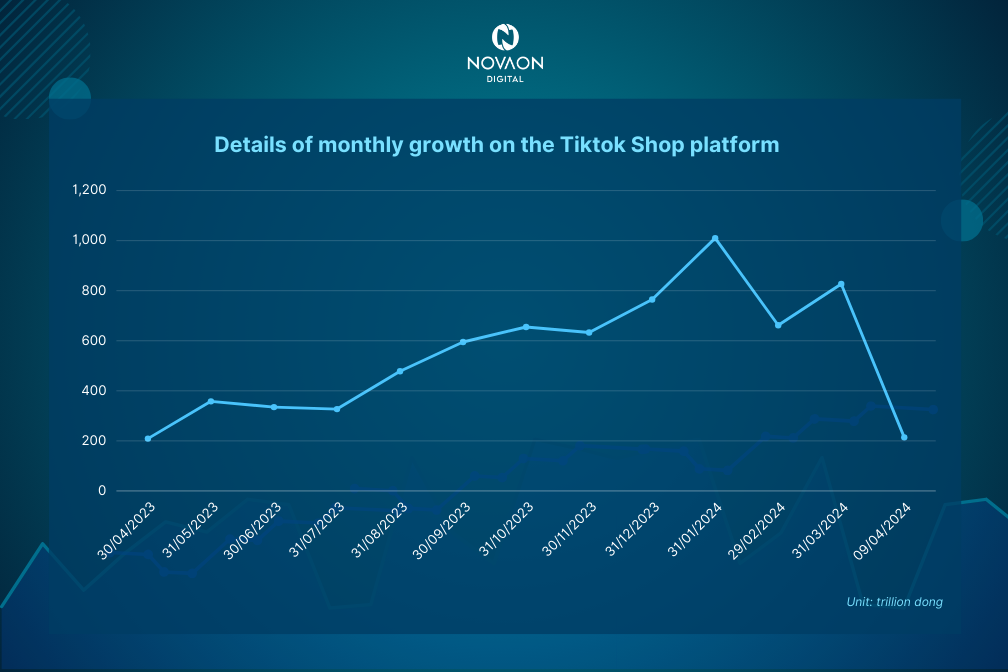

Although the market was launched quite late, however, by the end of 2023, TikTok had surpassed Lazada and ranked 2nd with a market share of 11.1% of the market. Tiktok is gradually singing to develop the consumer electronics market and help the revenue of small goods industries surpass significantly. Details of the growth of Tiktok Shop by month are as follows:

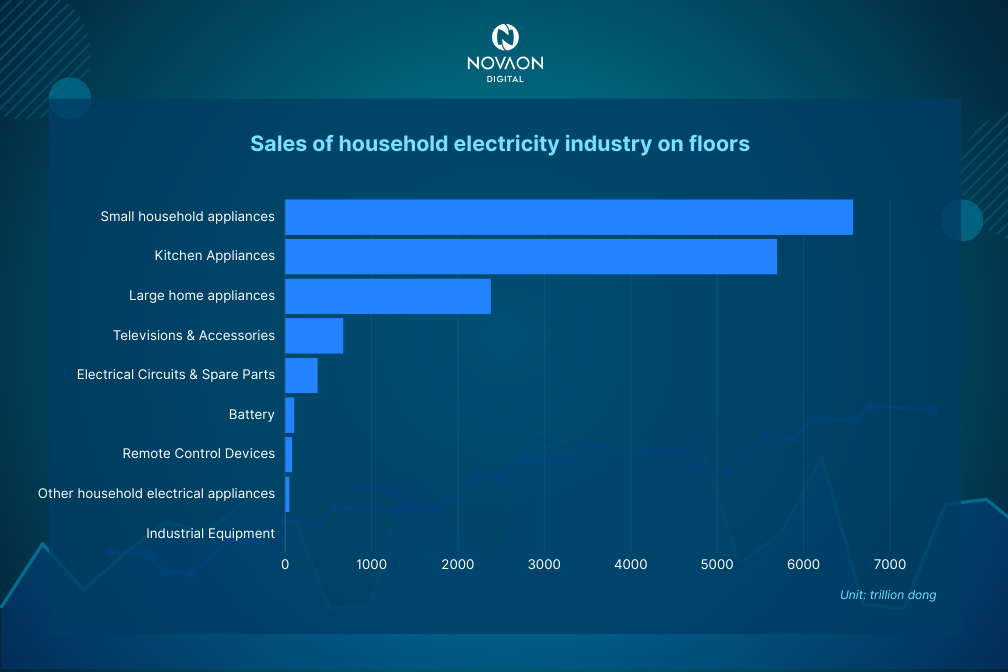

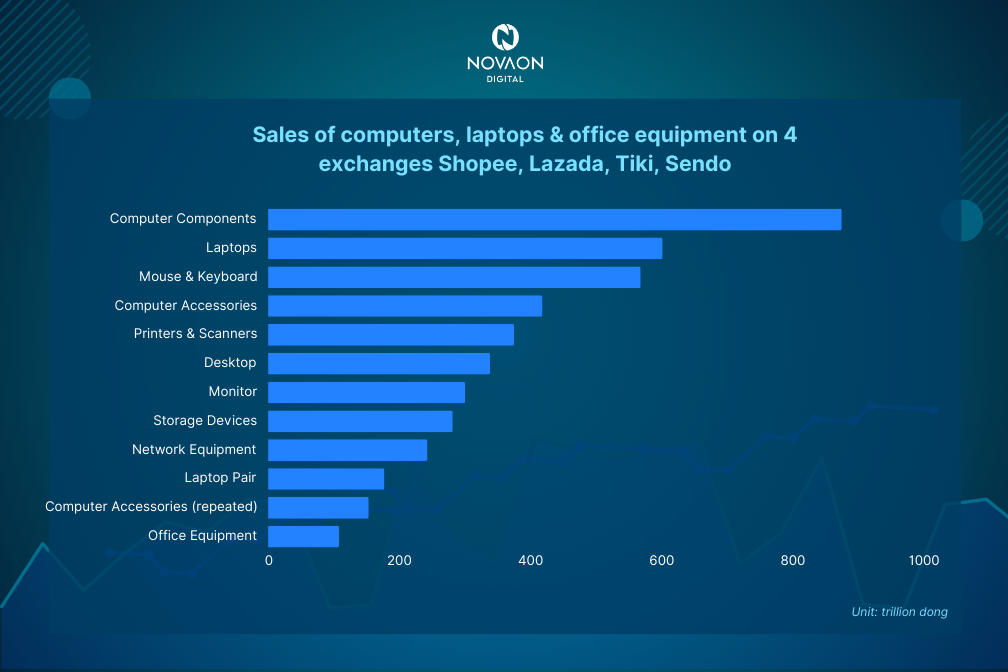

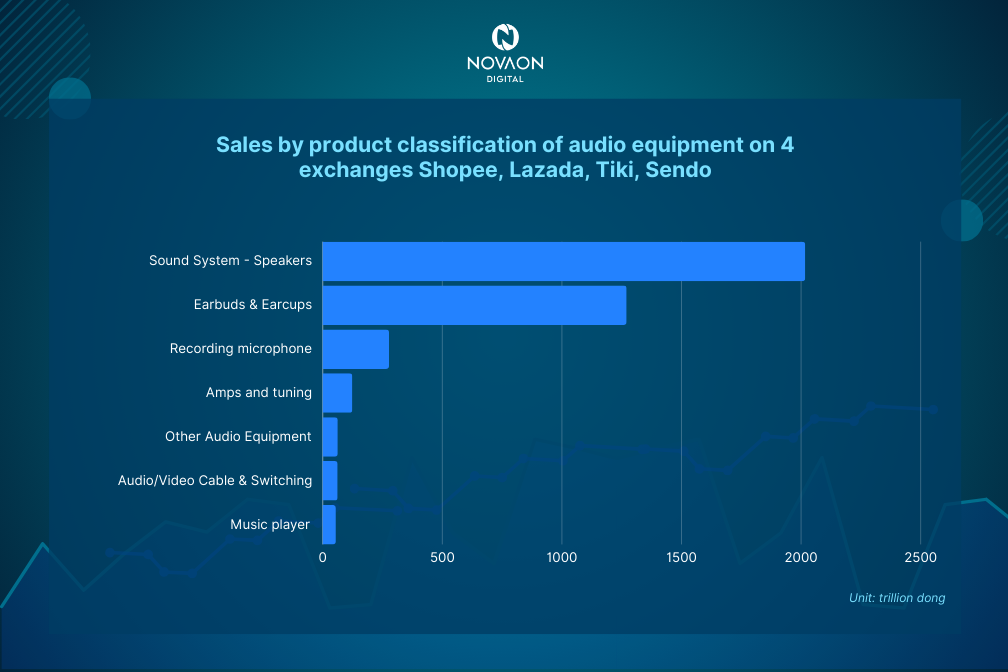

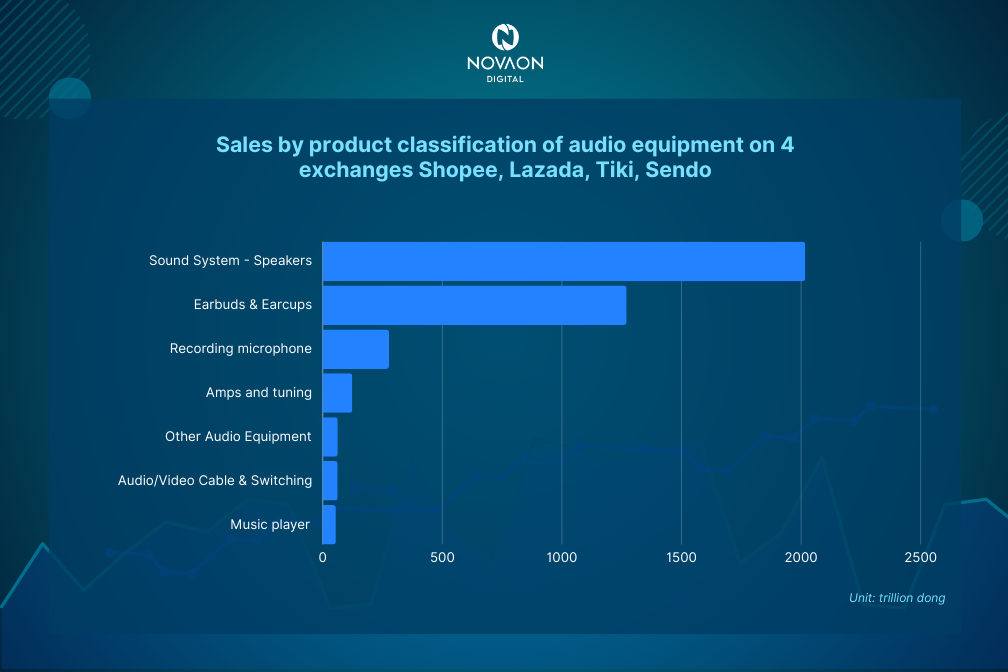

The statistics below are compiled from 4/2023 to 4/2024, measured on 4 platforms Shopee, Lazada, Tiki, and Sendo, showing consumer consumption and demand for each specific category.

Realizing that sales of categories grew quite well on e-commerce platforms. This proves that customers are gradually changing their shopping habits. Shopping on online platforms is somewhat more lively than that, in contrast to the gloomy atmosphere at physical stores. However, compared to the total revenue of the whole industry, the revenue growth on the e-commerce platform is insignificant.

After a period of hot growth due to the impact of the Covid-19 pandemic – causing the demand for electronic devices to support learning and remote work to increase, the purchasing power of consumers is weakening, business plans based on false growth expectations and the macroeconomic situation is not very positive, which has caused businesses to face a series of challenges.

2. Challenges for the Consumer Electronics Industry in 2023 and Opportunities for Recovery in 2024

a. Factors Affecting Consumer Electronics Businesses in 2023

Changing Consumer Behavior

Macroeconomic difficulties, along with rising electricity prices and living costs, have impacted consumer purchasing power. According to PwC’s report on consumer habits in Vietnam in 2023, up to 62% of consumers chose to cut back on non-essential spending, with 38% of them reducing their use of electronic products.

Instead of shopping based on personal preferences, many consumers have shifted to purchasing based on actual needs, prioritizing essential products with long-term value. Besides the key factors of brand, price, and quality, other aspects highly valued by customers include advanced technology, energy consumption, environmental impact, warranty policies, and promotional packages. In the battle for market share, understanding customer needs is the weapon that will help businesses succeed.

The Influx of Foreign Businesses

According to statistics from Metric over the 12 months (from April 11, 2023, to April 9, 2024), the top 10 brands with the highest revenue on Vietnam’s e-commerce platforms mostly come from countries like the U.S., South Korea, and China.

The absence of domestic brands requires Vietnamese businesses to develop smart and effective business strategies to enhance their competitiveness.

The Development of E-commerce

E-commerce offers a sales channel with lower costs, but it also brings pressure to lower prices due to price transparency and the ease of comparison between suppliers. According to a report from Metric.vn, the total revenue of the entire e-commerce market in Q3/2023 reached VND 63 trillion, achieving a growth rate of 54.42% compared to the same period last year.

Compared to electronics supermarkets and retail stores, the prices offered by sellers on e-commerce platforms are always more attractive due to subsidy policies from the operators. However, many consumers still hesitate to purchase high-value items such as smartphones, tablets, laptops, televisions, refrigerators, and air conditioners on e-commerce platforms due to concerns about quality assurance or receiving products that do not match the price paid.

These factors have had significant impacts on the Vietnamese electronics market.

The wave of spending cuts since the second half of 2022 has created excessive inventory pressure on consumer electronics retailers, leading them to continuously offer promotions and deep discounts to attract customers. To avoid losing clients, other retailers must do the same and even provide even larger incentives.

This strategy has led to the most intense price war in history. Sustained price reductions have significantly decreased the profits of retailers. Furthermore, the consumer electronics industry has witnessed a dramatic “price drop” for key items such as smartphones (down from 2 to 14 million VND each), laptops (down from 5 to 10 million VND each), and consumer electronics and home appliances (down from 50 to 70% per product).

The consequence of this price race is that retailers are struggling to sustain operations in a fiercely competitive environment and under heavy economic pressure.

According to statistics, in the first quarter of 2023, the revenue of the largest retailer dropped by 25.7% compared to the same period, and after-tax profit was only 21.28 billion VND, a decrease of 98.5% compared to the same period in 2022, marking a record low since going public.

The demand for non-essential items has sharply declined in the context of a challenging economy, coupled with the trend of shifting consumer spending toward online shopping, causing many retail stores to close en masse. Thế Giới Di Động closed nearly 150 stores within two months, with the number reaching 200 stores by the end of 2023, while FPT Shop closed 36 stores and reported a record loss of 329 billion VND.

Given the bleak outlook for the consumer electronics market in 2023, the most pressing question is whether 2024 will present opportunities for recovery or pose even greater challenges for the industry.

Retail representatives believe that in 2024, the macroeconomic environment will still be a barrier for the consumer electronics sector, and the market will continue to face difficult and challenging times. However, experts maintain that there are still grounds for optimism regarding the industry’s recovery potential.

b. Opportunities for Development for Vietnamese Consumer Electronics Companies in 202

After experiencing a significant revenue drop of 20-25% in retail sales of phones and electronics in 2023, experts anticipate a recovery in product sales of about 5% compared to the same period in 2024. This assessment is based on the considerable potential for growth in the home appliance sector in Vietnam, which remains largely untapped.

According to Euromonitor, the average age in Vietnam is 31 years—an age group that typically engages in shopping—while average income is improving (3,000 USD per person per year). Although most Vietnamese households already own essential household items, the demand for purchasing new or upgrading basic home appliances is still on the rise.

Additionally, the population in Vietnam is steadily and consistently increasing each year. This creates a significant opportunity for businesses in the consumer electronics sector, as the demand for purchasing and upgrading electronic devices—from smartphones and tablets to home appliances like washing machines, refrigerators, and air conditioners—is continuously growing.

To effectively capitalize on the market’s potential, companies need to make concerted efforts to seize opportunities and implement appropriate marketing strategies that align with market fluctuations and industry trends. This approach will help restore business activities and achieve revenue growth in the upcoming period.

3. General Trends Forecast for the Consumer Electronics Industry 2024-2025

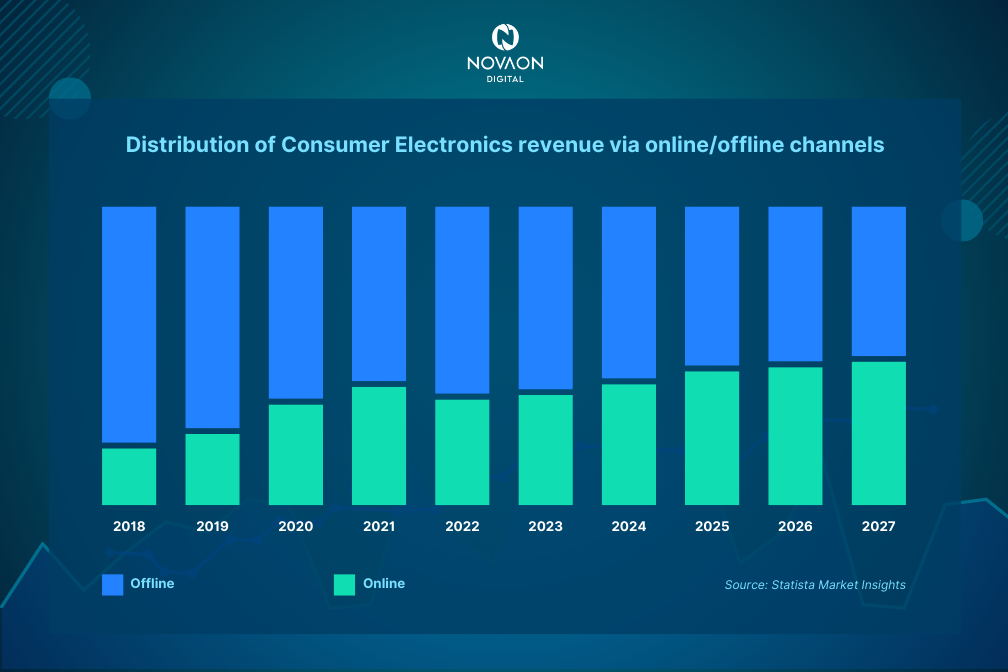

a. Consumer Market Forecast: Online Shopping Channels Will Continue to Develop

After more than a decade of robust activity in Vietnam, e-commerce platforms have redefined shopping habits for consumers. Previously, consumer electronics were not prioritized on online shopping channels. Now, with support to embrace technological trends and facilitate the launch and growth of online businesses through e-commerce platforms, along with commitments to warranty and after-sales service, consumer electronics products are increasingly appearing on e-commerce platforms and receiving greater favor from consumers.

According to the Vietnam E-commerce White Paper 2023, technology and electronics account for 39% of the total online shopping choices of consumers. With support from e-commerce platforms and the trend of online shopping, consumer electronics businesses can fully leverage this opportunity to reap the benefits of this business model.

b. Spending Trend Forecast: Increased Demand for Upgrading and Replacing Household Electronic Devices

Statista notes that as the economy recovers, consumer spending will increase, and the demand for upgrading and spending on consumer electronics will gradually rise as well. In terms of per capita revenue, each person in Vietnam is expected to generate revenue of $79.71 in 2024—a significant increase compared to 2023.

Additionally, the high proportion of young people in the population leads to many changes in the demand for the quality, design, and functionality of electronic and household products.

The recovery of the economy, increasing consumer spending, and a young population will provide strong momentum for the recovery of the consumer electronics market in Vietnam in the upcoming period.

c. Development Forecasts: Smartphones and Personal Computers Will Lead in Consumption

The consumer electronics market in Vietnam is witnessing a surge in demand for smartphones and smart TVs. In the first six months of 2023, Vietnamese consumers spent $2 billion (49.2 trillion VND) on smartphones, making it one of the highest spending categories in the Asia-Pacific region.

2024 will also be a time for upgrading devices such as smartphones and laptops following the peak purchasing period in 2021. This aligns perfectly with the forecasted trend that Vietnamese consumers will focus on advanced technology and be willing to upgrade personal devices to meet new demands and trends.

The projected trends in the consumer electronics industry are not only indicators of technological and product development but also play a crucial role in understanding changing consumer behavior and how businesses approach customers.

In the face of challenges due to market fluctuations and changing consumer trends, companies need to find new directions to optimize their marketing strategies to overcome market difficulties and achieve sustainable growth.

To support businesses in building effective Brandformance strategies for the period of 2024 – 2025, Novaon Digital has launched the Consumer Electronics & Home Appliances Brandformance Guides 2024. This resource will provide a comprehensive overview of the market, customer insights, creative marketing strategies, solutions to effectively balance branding and performance, as well as successful Brandformance implementation lessons from various domestic and international brands.

Register to receive information about the guides: Here