3 Impressive Automotive Case Studies by Novaon Digital

I. The Automotive Market and the Customer Experience Challenge

The Automotive Market: When Customers Change the Way They Buy Cars

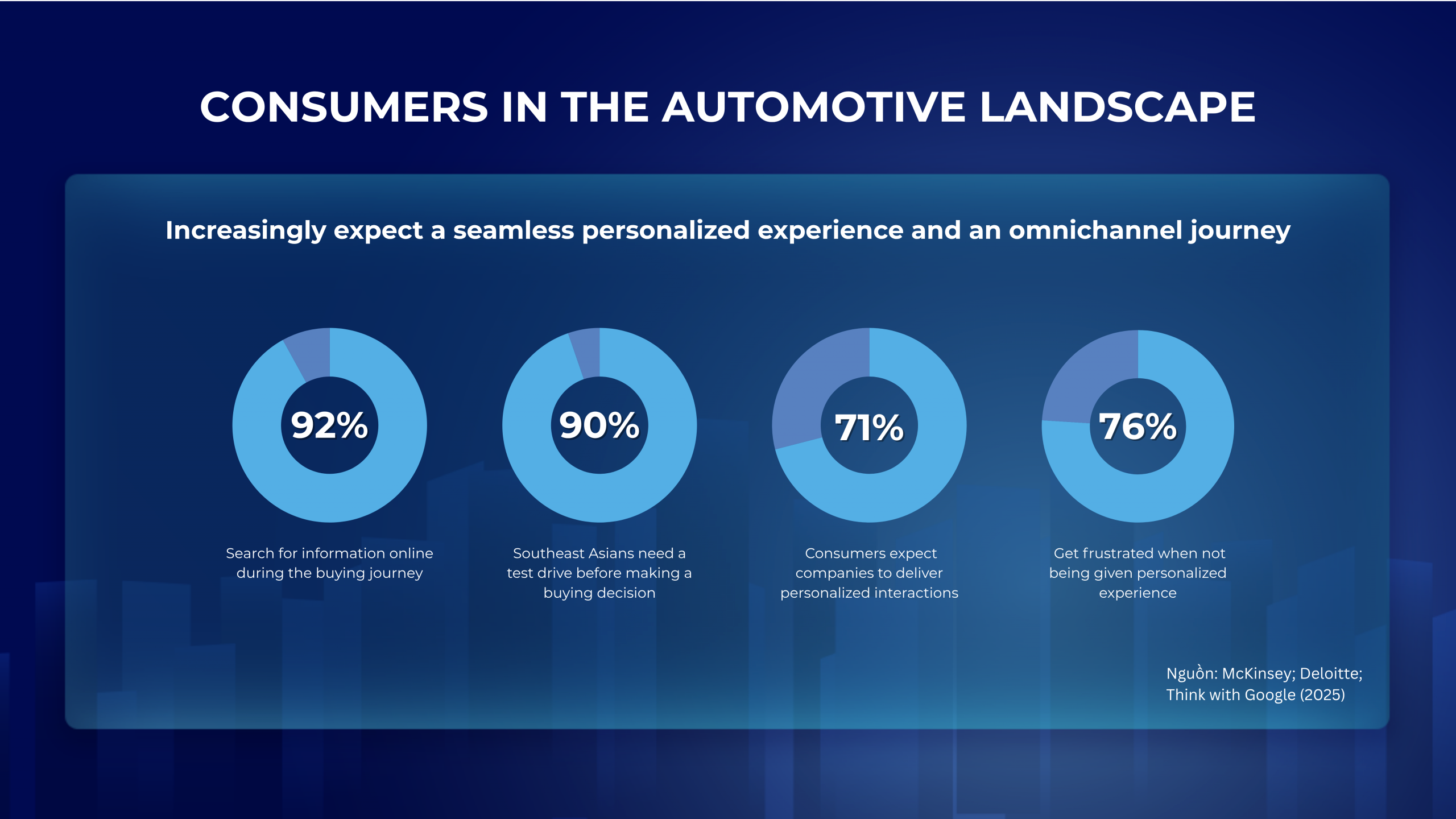

Competition in Vietnam’s automotive industry has never been more intense, especially in the luxury and SUV segments. The biggest difference compared to a few years ago lies in customer behavior – visiting showrooms is no longer a natural habit. Instead, the car-buying journey now begins on smartphone screens: searching for information on Google, watching reviews on YouTube, comparing prices on forums, and even seeking opinions in Facebook groups before deciding to visit a dealership.

Target Customer Psychology in the Vietnamese Automotive Industry

(Source: Novaon Digital)

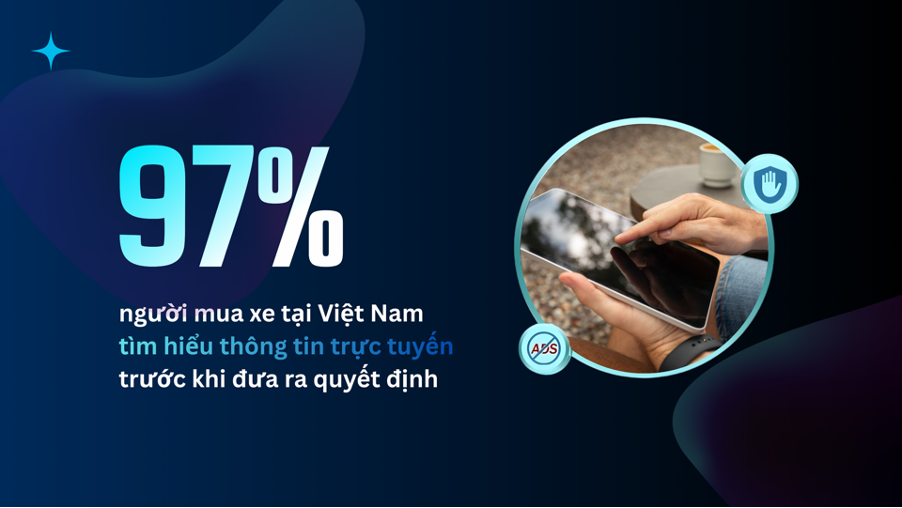

Research from Google shows that up to 97% of car buyers in Vietnam research online before making a decision. This poses a major challenge: brands not only need to be present on digital platforms but must also create experiences strong enough to convert interest into action. Customers are not lacking information – they lack reasons to trust and choose a specific brand.

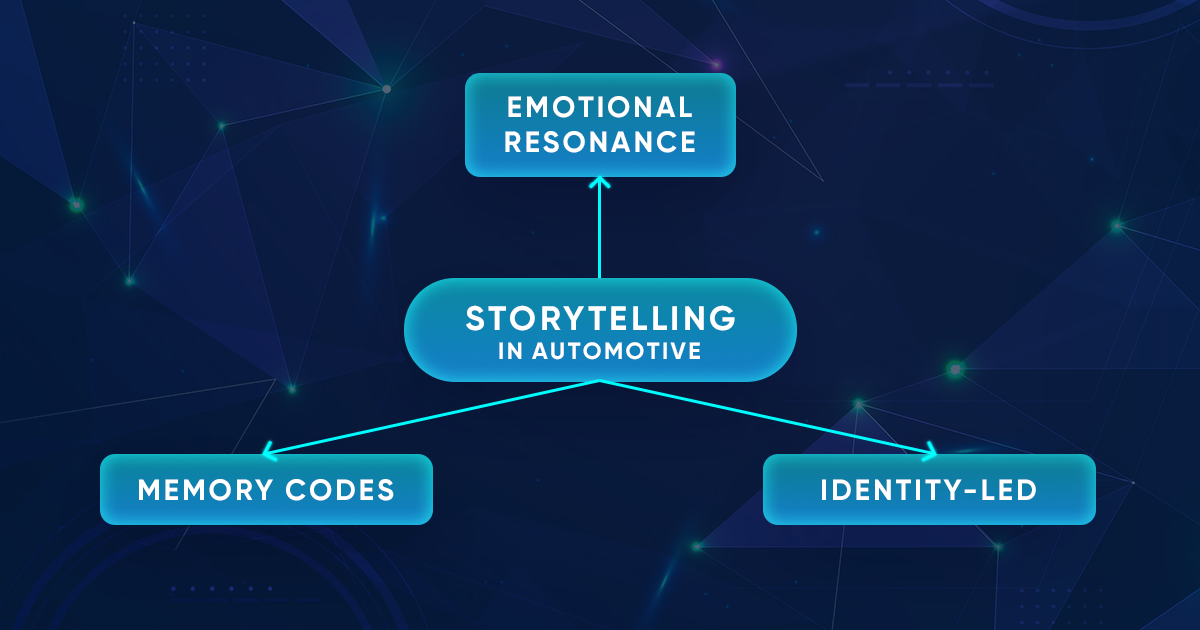

The key insight here is that car buyers are not just purchasing a means of transportation. They are buying a sense of safety for their families, a statement of social status, and modern technological experiences. Therefore, everything a brand communicates from the very first touchpoint – whether it is an advertising video, a fanpage post, or a website banner – must tap into those underlying desires. If brands stop at listing technical specifications or price promotions, they will quickly be forgotten among hundreds of similar messages every day.

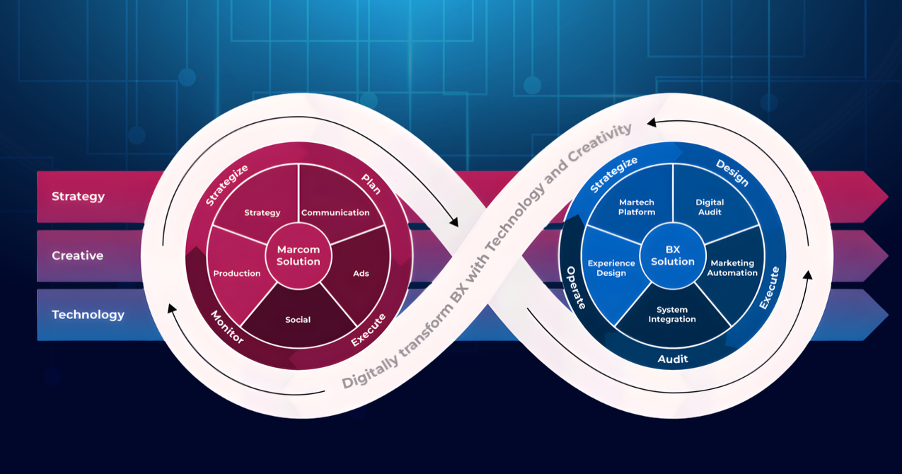

The SCT Model: A Foundation for Brand Experience in the Automotive Industry

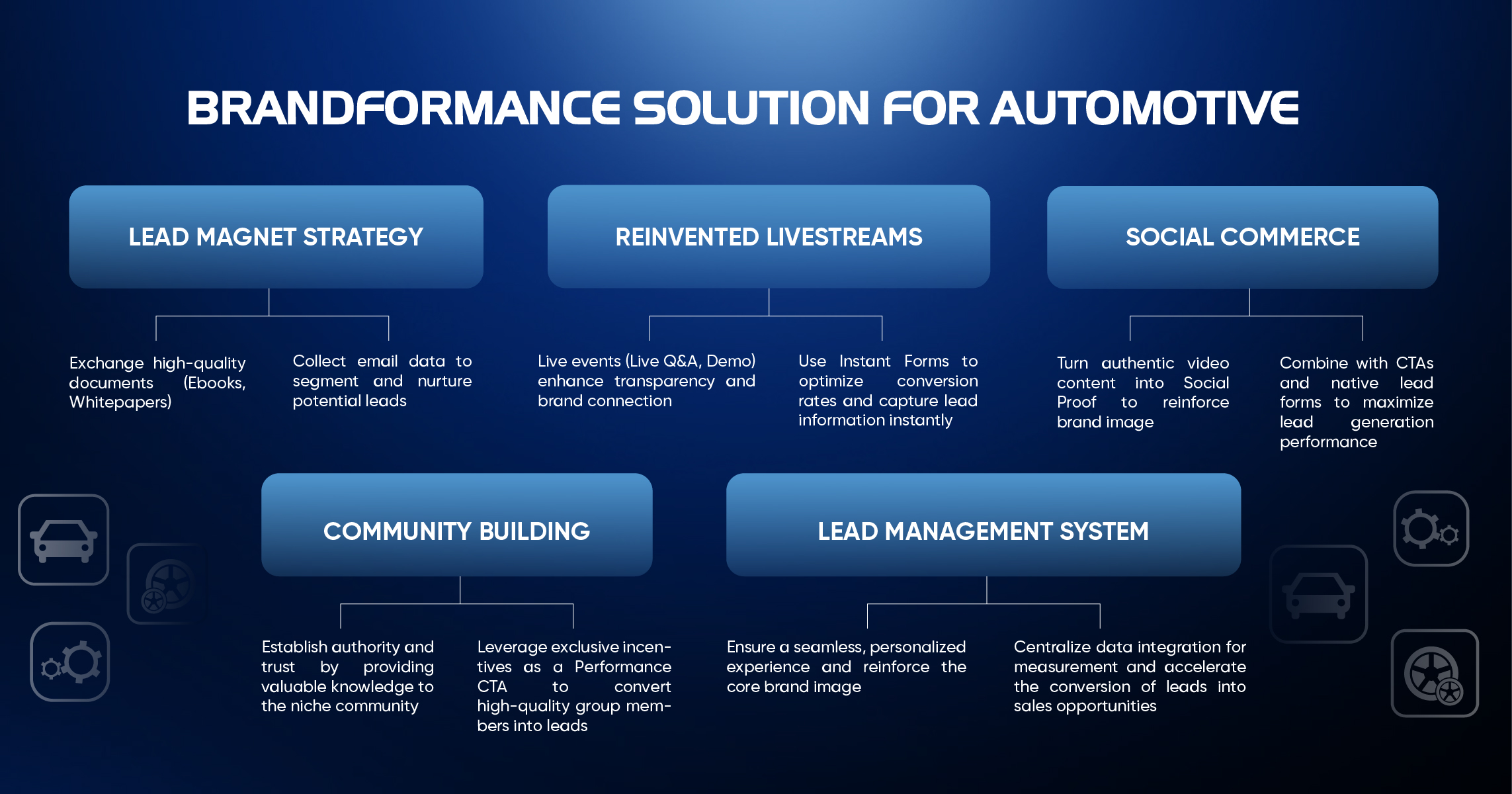

To solve this challenge, Novaon Digital has developed and applied the SCT model – the intersection of Strategy, Creative, and Technology. These three elements do not operate independently but are always intertwined, supporting one another to create a comprehensive Brand Experience system.

Novaon Digital’s SCT Strategic Model

(Source: Novaon Digital)

Strategy plays a foundational role, helping brands deeply understand customer behavior – not only what customers say, but also what they truly desire yet have not expressed. From there, Creative transforms these insights into impactful ideas that help brands stand out amid a “forest” of monotonous advertising. Finally, Technology ensures that all activities are accurately measured and optimized in real time through MarTech tools, AI, and Data Analytics.

The strength of this model lies in the fact that it not only creates visually appealing campaigns but also delivers concrete business results. Every creative decision is supported by data, every strategy is executed through technology, and every technology serves the ultimate goal: converting potential customers into actual buyers. Below are three typical case studies that demonstrate how Novaon Digital applies the SCT philosophy to create breakthroughs in the automotive industry.

II. Three Impressive Automotive Case Studies by Novaon Digital

Based on market context, customer insights, and the SCT philosophy, Novaon Digital has partnered with many automotive clients on major communication strategies, delivering remarkable results. Below are three impressive automotive case studies by Novaon Digital.

Case Study 1: BMW – Turning the Tide in the Luxury Car Segment

The period of 2022–2023 was not an easy time for BMW in Vietnam. The brand decided to expand its dealership network to increase customer reach, but the market was witnessing a clear decline in demand. For a luxury car brand, the challenge was not only reaching more people but reaching the right people – customers with purchasing power who were seriously considering cars priced at billions of VND.

Luxury car customers have a distinct characteristic: they do not lack money, they lack a compelling reason to choose a brand. They want to experience premium value from the very first touchpoint – not necessarily at the showroom, but right on their smartphones. Therefore, BMW needed to create a differentiated experience that would make customers want to own the car immediately.

Campaign Collaboration Between Novaon Digital x BMW

(Source: Novaon Digital)

Novaon Digital implemented a Meta AR campaign inspired by the legendary game Need for Speed. Instead of merely viewing images or videos, customers could “test drive” the BMW 3 Series directly on their phone screens – steering, accelerating, and cornering in a vivid virtual environment. This was not just advertising but an experience that allowed users to feel the power and prestige of the vehicle. At the same time, PR content and sponsored car launch events were widely amplified on social media, generating organic conversations within the car enthusiast community.

To optimize performance, Novaon Digital deployed the Onlead solution – an ecosystem that records real-time user behavior across multiple platforms. The system integrates with a Call Center to qualify lead quality before pushing data into CRM. A key highlight is that data is fed back to Meta to continuously optimize advertising, creating a closed-loop improvement cycle.

Results: vehicle sales increased by 13% YoY, test-drive registration rates rose by 43%, and the number of potential customers increased by 50%. BMW achieved 30% SOV – the highest search position on Google – with more than 500,000 searches in the first six months of 2023.

Case Study 2: Toyota – Winning Over Gen Z on TikTok

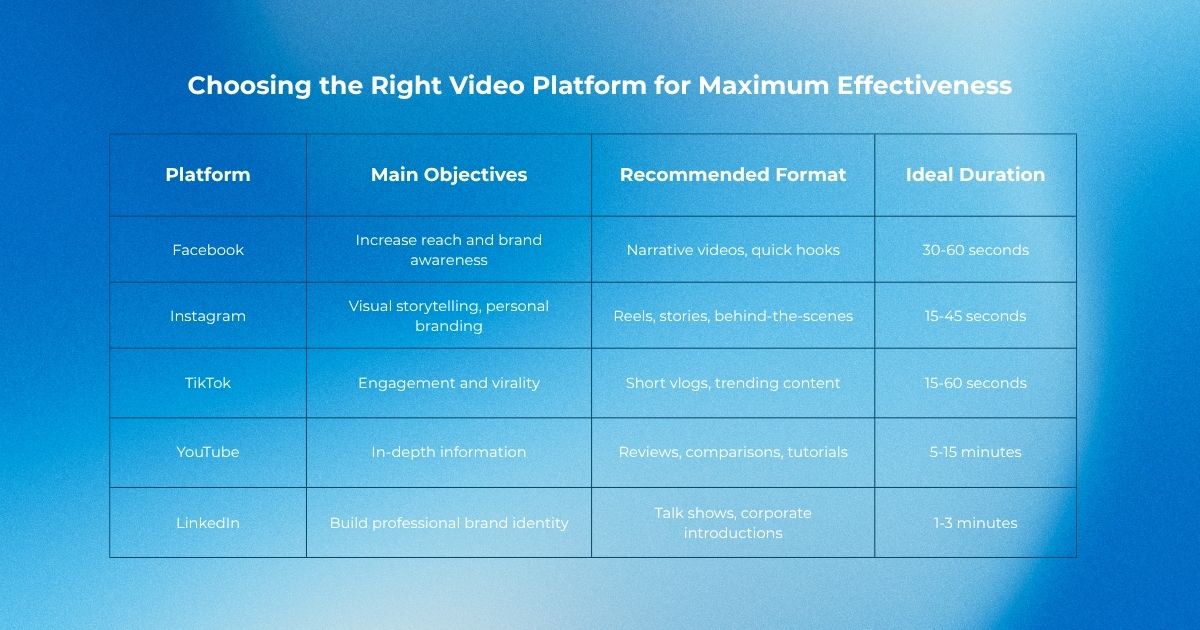

When Toyota decided to leverage TikTok in 2023, many were skeptical: could an automotive brand fit a platform where users mainly come to watch 15-second entertainment videos? However, Toyota recognized that Gen Z and Millennials – those who will buy cars in the next 5–10 years – spend most of their time on TikTok. Without a presence there, the brand would be absent from the minds of future customers.

The biggest challenge was not appearing on TikTok, but avoiding being “off-putting” in an environment where users are extremely sensitive to hard-selling ads. Gen Z does not want to be “sold to” – they want entertainment, learning, and connection. Therefore, traditional polished product advertising would not be effective.

Campaign Collaboration Between Novaon Digital x Toyota

(Source: Novaon Digital)

Novaon Digital transformed Toyota’s TikTok channel into an “engaging content hub” rather than an advertising page. Videos were produced in TikTok’s native “language” – concise, trend-driven, surprising, and providing real value. Instead of saying “Toyota cars are great,” the videos told real-life stories: families traveling long distances, young drivers sharing their first driving experiences, or tips on using in-car technology features. Interactive minigames were subtly integrated, turning viewers into players – they participated, shared, and created their own content.

The Hashtag Challenge campaign combined with KOLs and KOCs helped content spread organically – not because Toyota paid for ads, but because the content was genuinely engaging. At the same time, Performance Marketing was implemented in parallel, precisely targeting users interested in cars and optimizing based on behavioral data. Engagement levels, watch time, and conversion tracking technologies enabled continuous strategy adjustments.

Results: the TikTok channel reached over 245K followers, 195,245 likes, with an average of 546,000 views per video, and a peak video reaching 6 million views. Toyota not only increased brand awareness but also built a youthful community – a solid foundation for long-term strategy.

Case Study 3: Peugeot – Turning the Tide During the Pandemic

In 2021, COVID-19 heavily impacted the automotive industry, and Peugeot faced serious sales declines for many months. Toward the end of the year, when the market began to reopen, the brand recognized a “golden moment” to break through – but had only one month to get ahead of competitors. This was a major gamble: could the situation be reversed in such a short time?

After lockdown, customers craved real-life experiences but remained cautious about direct contact. They wanted to interact with brands in a safe, creative, and personalized way – not simply watch ads or read product information. Therefore, Peugeot needed a powerful idea that could both create emotional connection and drive purchase actions in a short period.

Campaign Collaboration Between Novaon Digital x Peugeot

(Source: Novaon Digital)

Novaon Digital launched the “Color in E-Motion” campaign – a creative competition on a microsite allowing customers to design their own Peugeot car decals. This was an outstanding application of gamification: customers did not just view ads, they participated in creation, turning their ideas into reality on their dream cars. After designing, participants received PSD files to use and share on social media, creating organic viral effects. The brand did not need to “push” – customers voluntarily spread the campaign because they were proud of their own creations.

Alongside the creative idea, Novaon Digital applied AI technology to optimize advertising content. The system analyzed the performance of each ad creative by customer segment, automatically identifying the most effective versions – not based on guesswork, but on real data. The integrated Sales-CRM system was upgraded to fully leverage online data. Every participant in the competition was tracked throughout their journey, enabling suitable remarketing campaigns.

Results exceeded expectations in just one month:

- Sales volume increased 48% MoM and 4x YoY, with Peugeot leading the European SUV segment in Vietnam.

- Test-drive registration rates increased by 24%, conversion rates increased 1.5x, and operational efficiency doubled.

- Peugeot proved that even in crisis, when creativity and technology are combined effectively, brands can achieve remarkable turnarounds.

IV. Expert Perspective

The automotive industry no longer competes on products or price, but on the ability to create seamless brand experiences. The three case studies of BMW, Toyota, and Peugeot demonstrate that when creative ideas meet effective execution, brands not only increase sales but also build sustainable trust with customers.

The integration of strategy, creativity, and technology is not a choice – it is a necessity for automotive brands that want to lead the market. This is the only way to turn challenges into opportunities and transform potential customers into loyal advocates.

With nearly 20 years of experience, Novaon Digital proudly serves as a strategic partner for leading automotive brands, building Brand Experience based on the SCT (Strategy – Creative – Technology) foundation. From BMW, Toyota, and Peugeot to VinFast and Skoda – every campaign is a testament to execution capability and breakthrough thinking.